Fourth Quarter 2023: Inflation Down, Everything Up

Stocks, Bonds and Other Risk-Ons Shoot Higher After Inflation Comes in Below Expectations Almost Everywhere

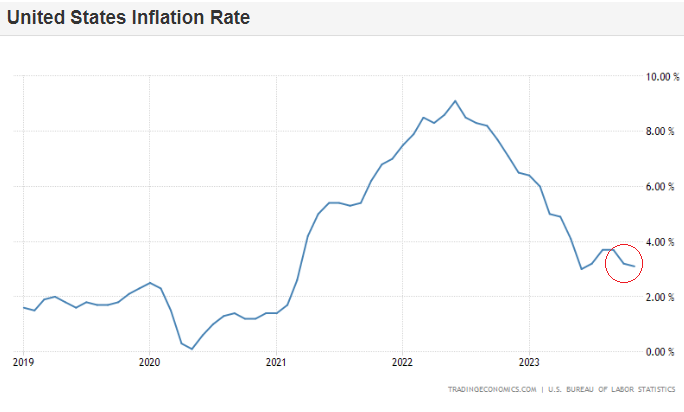

After a brief inflation scare in mid-2023, which was the primary culprit for weak stock and bond performance from July to October, the US consumer price index (CPI), broadly seen as a global benchmark for inflation, resumed falling toward more normal levels beginning in October.

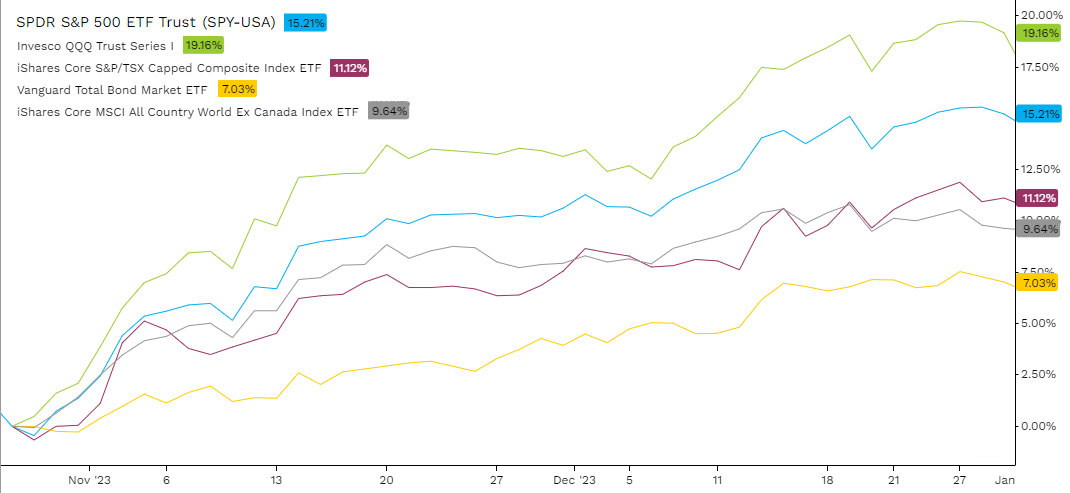

It doesn’t look like much more than a blip on the chart above, but investors cheered the news of a continuation of the falling inflation trend, partly because the US Federal Reserve chairman Jerome Powell confirmed that its key/policy interest rate is ‘likely at or near their peak for this tightening cycle’, at a time that many forecasters were still expecting more interest rate hikes. Oil prices also hit six-month lows in December, reinforcing the trend of disinflation. Many major stock indices around the world posted returns between 10% and 20% since the October lows, more than offsetting the ‘inflation scare related losses’ incurred since July. This inflation related optimism was felt in bond and currency markets as well. Prior to October, US bond markets were pricing in just two to three 0.25% interest rate cuts toward the end of 2024 but the bond market rally since October has officially priced in a much more aggressive campaign of seven 0.25% interest rate cuts in 2024, with cuts starting as early as March. Returns for various major stock and bond indices since the inflation scare lows on October 26th, are outlined in the chart below.

Equity and Bond Index Returns From October 26th to December 31st

This optimism about falling inflation and lower interest rates was priced in nearly everywhere around the world, as not just the US posted lower than expected inflation numbers. In Canada, the 5-year Government of Canada bond yield fell from as much as 4.5%, all the way down to 3.2% in late December, providing a sigh of relief for heavily indebted borrowers. Mortgage rates follow Canadian government bond yields closely so lower bond yields means lower mortgage rates upon renewal. Renewing one’s mortgage at 4.5% versus 6.5% could be make or break for many households, especially in Canada, where household debt levels are some of the highest in the world.

Lower interest rates result in less financial market stress as there are fewer households and businesses being pushed to the edge due to high interest costs. That said, it is important to remember that even though interest rates are a bit lower than a few months ago, most borrowers are paying much more in interest than they have in recent years. Those with variable debt (variable rate mortgages, lines of credit, credit card debt, etc.) are still experiencing high interest rate stress as very short-term rates have yet to decline, while borrowers with fixed-term debt (fixed rate mortgages, personal loans, etc.) are likely to be renewing this debt at higher yields than before as interest rates remain well above levels seen in the 2010s and early 2020s. Investors are excited that lower inflation and interest rates will usher in a soft landing for the economy, but many of the effects of higher interest rates are still in front of us, and it is difficult to tell if high interest rates will push various economies into recession in 2024 and beyond. Some economies are more susceptible to higher interest rates than others due to the term of debt held, so we may begin to see some major differences in economic performance from country to country.

For example, Canadian households carry variable rate mortgages or fixed rate mortgages with terms of five years or less, and see their debt reset at higher rates quickly, while American households generally carry 15- and 30-year mortgages, and existing borrowers not affected by higher interest rates. This difference can cause Canadian discretionary income to decline much faster and greater than American discretionary income in times of rising or higher interest rates and can have a significant impact on each country’s respective GDP growth and currency outlook. The Canadian economy has underperformed the US economy by a wide margin in recent quarters, and this is likely to continue as Canadian households reel in spending to service higher debt payments.

How To Position Portfolios Going Forward?

It is normal for investors to bid up stocks and bonds following the “Fed Pivot” (i.e. when the US Federal Reserve indicates a shift from raising interest rates to cutting interest rates). In the past, stocks and bonds consistently performed well in the weeks and months following a “Fed Pivot”, or the market’s anticipation of a pivot. The not-so-great news is that stock and bond performance beyond those weeks and months following a “Fed Pivot” is highly variable, with some instances seeing a continuation strong returns and other instances being some of the worst periods in history. The differentiator between these instances tends to be the overall strength of the economy heading into the “Fed Pivot” combined with market valuations.

The global economy is looking particularly strong heading into this “Fed Pivot”, which may indicate a steady-as-she-goes stock and bond market outlook. Labour markets around the world have been quite resilient, with unemployment rates still near historic lows, and with job postings still elevated relative to the pre-COVID period. Major recessions and market drawdowns of the past were often precipitated by significant spikes in unemployment, and that does not seem to be a near-term risk in most developed economies. Business and consumer delinquencies and bankruptcies are on the rise as higher interest rates cause financing costs to bite, but they remain in line with pre-COVID norms. Without rapidly rising unemployment, it is difficult to see how delinquencies and bankruptcies would spike to recessionary levels anytime soon.

Overall market valuations are elevated, driven by very high valuations in the US technology sector. Despite broad equity markets trading at or within reach of their all-time highs, many stocks in the other ten non-technology sectors are still trading near multi-year lows and at valuations that are below average, something we highlighted in our Q3 commentary. Most of these stocks participated well in the equity market rally since October but are still valued to provide attractive returns over the long term. We continue to believe holding dividend-paying, blue chip and non-cyclical stocks with manageable debt loads should help provide somewhat predictable returns over time. As the outlook for the US economy is a bit better than Canada’s economy, it may be prudent to allocate more to US dollar denominated securities. This will factor into our security selection throughout 2024.

Preferred equities rallied alongside bonds since October. The preferred equities we favour, those which recently saw their dividend reset and those with upcoming dividend resets, rallied far more than average as investors poured into these highest yielding preferred shares. Despite the recent rally, preferred shares appear to be one of the better opportunities available in investment markets. We continue to maintain preferred equity exposure and will expand or reduce this exposure as individual opportunities arise.

As to be expected, alternative investments, which generally have a smoother and more consistent return profile, underperformed most other asset classes as other asset classes rallied strongly. Looking forward, now that bond yields are in the 4% range and equities are a little more highly valued than just a few months ago, alternative investments are beginning to look particularly attractive again. Bolstering our allocations to alternative investments will be a priority in 2024, especially if and when we take profits elsewhere.

We continue to structure your portfolio for the long term with well diversified high-quality securities and including an allocation to alternative investments. We are consistently reviewing the relative returns of each asset class and adjusting portfolios as opportunities arise.

If you ever have any questions or concerns about your portfolio or the investment markets in general, please feel free to reach out to us.

Sincerely,

Steele Wealth Management

The information contained in this report was obtained from sources believed to be reliable, however, we cannot present that it is accurate or complete. Information has been sourced from the RJL Bond Desk or RJ Private Client Solutions, unless otherwise noted. Index and sector returns represented in this commentary are measured using the S&P/TSX Total Return Index and S&P/TSX GICS Sector Indices as detailed in Raymond James Ltd.’s Insights & Strategies: Quarterly Edition. This report is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell securities. The views expressed are those of the author and not necessarily those of Raymond James Ltd. (Member Canadian Investor Protection Fund).

This Quarterly Market Comment has been prepared by Steele Wealth Management and expresses the opinions of the author and not necessarily those of Raymond James Ltd. (RJL). Statistics and factual data and other information are from sources RJL believes to be reliable but their accuracy cannot be guaranteed. The performance outlined in the report is net of fees. The client account performance may vary from the model portfolio due to several factors, including the timing of contributions and dates invested in model. The performance reported is that of the account that represents the model, not a composite. Performance calculation for the models may be different than the index used as a reference point. It is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. This Quarterly Market Comment is intended for distribution only in those jurisdictions where RJL and the author are registered. Securities-related products and services are offered through Raymond James Ltd.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.