CPP 2.0 Starts January 1st. What to Expect and How It Affects Your Retirement Income Plan.

As of 2019, the Canada Pension Plan (CPP) has been gradually raising contributions to enhanced CPP benefits in retirement. The end goal is to boost the maximum CPP retirement benefit by 50% for workers who contribute to the enhanced CPP for their entire lifetimes (i.e. those who start contributing to CPP in 2026 and beyond). Those workers who have already been contributing to the CPP prior to 2026 will receive an enhanced benefit but not one that is 50% greater than before 2019.

The enhanced CPP now consists of:

- The base (or original CPP),

- The first additional component (CPP1), which was phased in between 2019 and 2023, and

- The second additional component (CPP2), which will be phased in between 2024 and 2025.

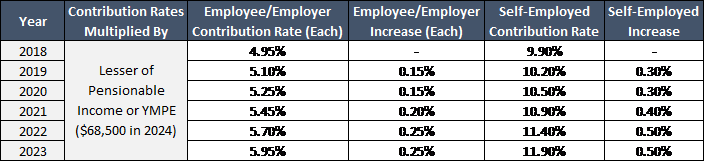

The first additional component involved gradually raising the CPP contribution rate for both employees and employers each year from 2019 to 2023. The CPP contribution rate is multiplied by the yearly maximum pensionable earnings (YMPE; $68,500 in 2024) to arrive at the required CPP contribution in dollars for each given year. The YMPE is the same figure used to calculate required CPP contributions as part of the original CPP. The schedule of increases that were phased in as part of CPP1 are detailed in the table below.

The first additional component resulted in employees and employers paying more into CPP, with contribution rates for both employees and employers rising from 4.95% of the YMPE to 5.95% of the YMPE. Self-employed individuals, who pay both the employee and employer portions, saw their contribution rates rise from 9.9% of the YMPE to 11.9% of the YMPE from 2018 to 2023.

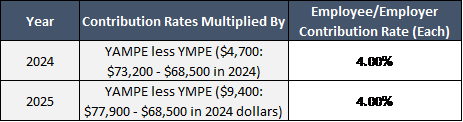

The second additional component, which starts in 2024, involves an additional range of earnings covered by CPP from the original earnings limit, or YMPE ($68,500 in 2024), to the new earnings limit, or Yearly Additional Maximum Pensionable Earnings (YAMPE), which will be ~7% above the YMPE in 2024 and ~14% above the YMPE in 2025. The contribution rates on these additional ranges of pensionable earnings are 4% for each the employee and employer. The additional CPP contributions that are to be phased in as part of CPP2 are detailed in the table below.

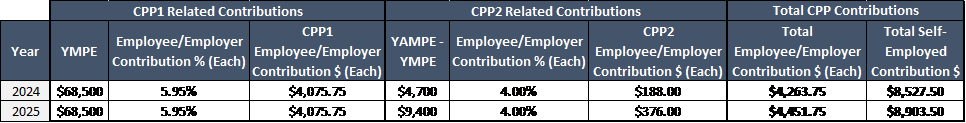

Total CPP contributions in years 2024 and 2025 for individuals who earn income at or above the YAMPE are mapped out in the table below. Figures are all presented in 2024 dollars because we can’t know how figures will be adjusted for inflation in 2025.

For comparison to years prior to 2019 and those with income above the YAMPE, total CPP contributions for an employee/employer will be $4,451.75 in 2025 versus $3,390.75 in 2018 (in 2024 dollars). For a self-employed individual with income above the YAMPE, total CPP contributions will be $8,903.50 in 2025 versus $6,781.50 in 2018 (in 2024 dollars).

While the difference in CPP contributions may go unnoticed by some, it may move the needle for self-employed individuals deciding whether to pay themselves in salary or dividends. A lot has changed from a tax and CPP perspective since 2019, so reviewing what has changed and reviewing whether to stick with previously established income plans is prudent.

Adjusting our clients’ income plans to account for changes to tax regimes and other legislation is core to our comprehensive and thorough planning approach at Steele Wealth Management. If you have any further questions regarding changes to the CPP or taxation and clawbacks on income withdrawn from corporations, please reach out!

News and our views

Canada on the Edge of Recession as High Interest Rates Bite. The Canadian economy unexpectedly contracted in the third quarter with GDP falling 1.1% quarter-over-quarter. International trade, particularly energy exports, fell significantly while a surprisingly positive note was housing investment, which jumped 8% quarter-over-quarter, after five straight quarterly declines. Consumer spending remains anemic, rising just 0.1% in the quarter as interest rates squeeze household budgets. Although the flash GDP estimate for October showed a 0.2% monthly increase, continued inflation and interest rate related pressure on consumers and housing investment is likely to keep a lid on Canadian economic growth.

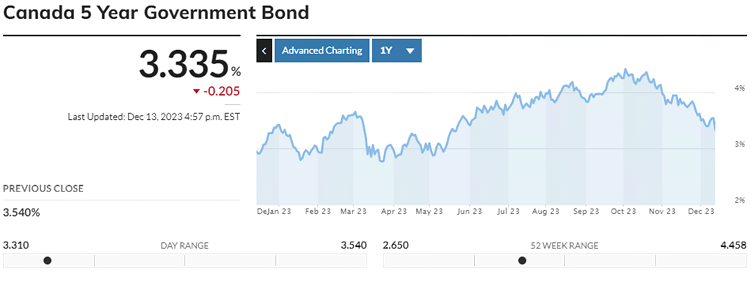

Our Take: We will soon find out just how soft of a landing the Bank of Canada can achieve for the Canadian economy. The GDP miss in the third quarter, combined with continued progress in the fight against inflation, likely means that there will be no more interest rate hikes this cycle. This has been “confirmed” in Government of Canada bond yields in recent weeks, with the 5 year bond yield falling from ~4.5% in early October to ~3.3% now, the lowest level in six months. Government of Canada bond yields and mortgage rates tend to move in tandem and are expected to track bond yields lower. Lower mortgage rates and the cost of debt in general could help restore consumer confidence and spending, or at the very least, prevent consumer spending from deteriorating further.

Oil Prices Hit Six Month Lows As Demand Comes Up Short and Supply Is On Tap. Oil demand has been lower than expected as Chinese economic activity has come in lighter than expected and the outlook for US and Chinese economic growth worsened in recent weeks. High interest rates are expected to continue to slow demand growth in many economies around the world. On the supply side, US oil production remains near all-time highs and there are growing doubts that OPEC+ will be able to maintain current supply cuts and/or tolerate additional cuts when there are already several million barrels of oil supply capacity offline. There are indications that OPEC+ solidarity may be fracturing which could unleash additional supply, pushing oil prices down further.

Our Take: It appears a lack of supply is not a problem in the oil market, and this is a great thing for energy consuming households around the world. Lower oil prices lead to lower gasoline prices. This immediately provides relief to household budgets. Natural gas prices in North America also hit a six-month low in recent weeks, adding additional relief to household budgets. Less stressed household budgets, due to lower energy prices as well as falling interest rates, could help in achieving a soft-ish landing for the economy.

Just for fun

- Wikipedia’s 25 most popular (English language) articles of 2023. Wikipedia articles, like Google searches, represent the time in which we live – our interests, our obsessions, our concerns, our controversies. This year, potentially world-changing ChatGPT rightfully garnered the most pageviews on Wikipedia. Many North Americans may be surprised to discover that cricket and soccer related topics as well as Indian films accounted for six of the top twenty-five articles. The top film on the list was Oppenheimer at #5, achieving more pageviews than the Barbie movie at #13, despite Barbie attaining greater commercial success. Arguably Oppenheimer-the-man’s backstory is a little more exhaustive than Barbie’s, which is why Oppenheimer-the-man was also on the list, ranking at #7.

- Christine Sinclair, the all-time leading goal scorer in international football and captain of the Canadian women’s soccer team for nearly 20 years, played her last international game on December 5th. Sinclair has committed to one more year of club football with the Portland Thorns but is officially out of the limelight of international soccer. Sinclair single-handedly put soccer on the map for many Canadians, inspiring generations of kids to take up the sport and headed a national team that was easy and fun to cheer for (i.e. they won often!). The GOAT will be missed on the field but will surely be a familiar face off the field for a long time to come.

- Steele Wealth Management is excited to welcome Greg Weiler to our team. Greg is a CPA & CFP who recently retired as a tax specialist and partner at BDO for Southern Ontario. Over his 35-year career at BDO, he specialized in advising clients on minimizing and deferring income tax, strategically structuring trusts and estate plans, and providing proactive tax planning advice on business sales, purchases, reorganizations and successions. Greg brings his extensive experience and expertise with tax planning to help guide our valued clients toward practical solutions to their investment tax issues. Greg was born and raised in Waterloo, attending high school at Bluevale Collegiate and attaining a Business degree from Wilfrid Laurier University. Find out how Greg and our team can help you. Get in contact today to congratulate Greg and see how we can help you untangle your financial life and put you on a smooth path forward.