CPP's Child Rearing Dropout Provision (CRDO) - Free Money For Those Who Qualify!

Understanding the Canada Pension Plan (CPP) and all of its intricacies takes a lot of self-study. Something as simple as estimating one’s retirement, spousal or disability benefits, something we help clients with at Steele Wealth Management, can take a good amount of time. There are few, if any, truly accessible ways to learn about the CPP in its entirety and estimate one’s CPP benefits.

One CPP-related topic we thought it would be valuable to highlight is the Child Rearing Dropout Provision (CRDO). The CRDO is available to those who:

- Had children born after December 31, 1958,

- Had low or no earnings because you were the primary caregiver of a dependent child under age 7,

- Received Family Allowance payments (or your spouse or common-law partner did), and

- Qualified for the Canada Child Benefit (or your spouse or common-law partner did)

To simplify the bullet points above, you likely qualify for and would benefit from the CRDO if you took time off or worked part-time after having children and your children are age 65 or younger.

How Does the CRDO Work?

Assuming you qualify for the CRDO, this provision applies when Service Canada calculates the base component of your CPP benefit. Service Canada will ‘drop out’ (i.e., not include) the months during the drop-out period (the period of time from your child’s birth to their age 7) when you had low or no earnings. Months are only dropped out of the equation if they act to increase your CPP benefit. This drop-out provision can help you qualify for the CPP disability benefit or CPP death benefit, should you fall under the minimum contributory requirement to qualify for these benefits. There is also a ‘child rearing drop-in’ provision that applies to the new enhanced CPP benefits (i.e., CPP 2.0) but we’ll save that for another time.

The effects of the CRDO can be significant for some CPP applicants, especially those who worked previously, had numerous children and stayed home with their children when the children were young. Below is an example of the CRDO in action.

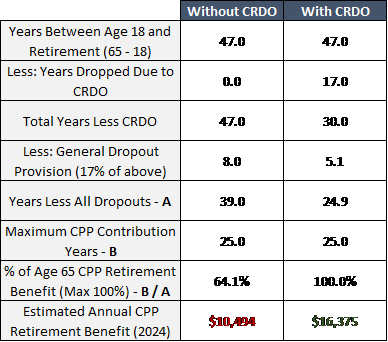

Let us introduce Betty. Betty was born in 1959 and is turning 65 this year (2024). Betty went to university and had a great job right out of school that allowed her to max out her CPP contributions each year she worked from 1980 to 1984. Betty got married and started having children in 1985. Betty had five children, with the oldest born in 1985 and the youngest born in 1995. Betty decided to stay at home after her first child and didn’t return to work until 2005. From 2005 to her retirement in 2024, she continued with her career, allowing her to max out her CPP contributions. Below is a summary of Betty’s estimated CPP retirement benefit at age 65, with and without the CRDO.

As you can see above, Betty would receive an additional ~$5,881 in annual CPP retirement benefits if she applies for the CRDO. Truth be told, this is one of the most extreme examples of the advantage of applying for the CRDO, but it does highlight how impactful the CRDO can be.

You apply for the CRDO when you apply for any CPP benefit. The option to apply for the CRDO is part of the CPP benefit application process, though some may have skipped applying for the CRDO as it requires that you list information about your children and provide a number of other details about the years following the birth of your children. The application can appear time-consuming and/or confusing, and some may have avoided completing the CRDO application for this reason. The good news is that you can apply for the CRDO after having started your CPP benefits and can receive retroactive payment for past benefits. Further, if someone receiving CPP benefits has died, the executor of their estate can apply for the CRDO on their behalf posthumously and their estate can receive the retroactive benefits they would have received if they applied for the CRDO during their lifetime.

We recommend that all parents who are receiving CPP benefits and who took time off or worked part-time after the birth of their children confirm that they applied for the CRDO. If you are not sure whether you applied for the CRDO when you applied for CPP benefits, you can apply for the CRDO now using Form ISP-1640. We also recommend that all executors verify that the deceased applied for the CRDO. If you are unsure whether the deceased applied for the CRDO, you can apply on behalf of the deceased as part of the estate windup process using Form ISP-1640 as well.

Helping clients understand the intricacies of the CPP and receive the maximum CPP benefits available to them is a key part of our income planning process. If you have any questions regarding the CRDO or the CPP in general, feel free to reach out to the Steele Wealth Management team!

News and our views

Canada’s Population Is Booming but Is the Economy? Canada’s population grew by more than 430,000 (1.1% population growth) in the third quarter of 2023. This quarterly growth was the fastest percentage growth in any quarter since 1957, when Canada’s population was only 16.7 million and growth was driven by post-war baby boom births and an influx of refugees resulting from the Hungarian Revolution of 1956. The vast majority (96%) of 2023 population growth was driven by international migration (e.g., temporary workers, foreign students and new permanent residents) while only a sliver (4%) was due to net new births. Looking at the year as a whole, Canada’s population grew by a whopping 3.2% in the year ended September 2023. New immigrants and non-permanent residents can help stimulate demand within the Canadian economy as newcomers need to buy necessities to help them get settled.

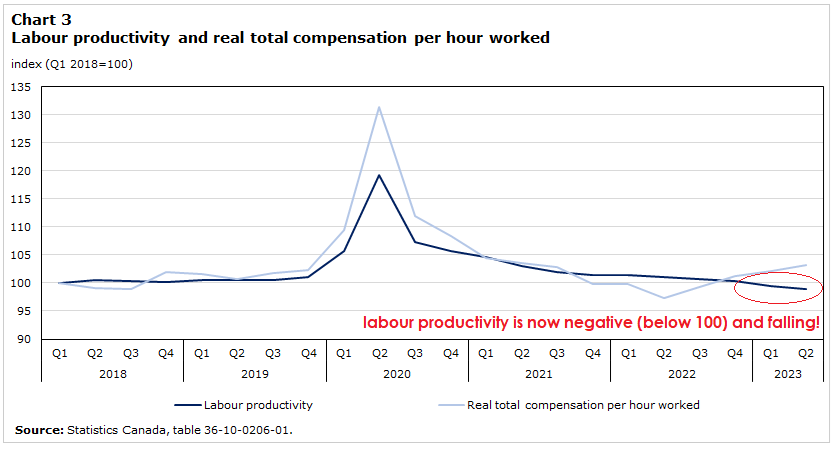

Our Take: Seeing as Canadian GDP growth was flat during the second half of 2023, even with this multi-decade high rate of migration, the Canadian economy would likely be in a glaring recession without this rapid international migration. While the broad Canadian economy is not in a technical recession, the average household is in recession, with real GDP per capita falling 1.4% over the year ended September 2023, and 5.4% annualized for the quarter ended September 2023. Part of the pressure on households is due to Canada’s unique housing shortage as rapid migration further pressures housing costs, for owners as migration works to boost inflation and interest rates, and for renters as competition for rental units outpaces new rental supply. A high rate of migration to Canada can help offset a shrinking workforce due to population aging, offset skills shortages in the workforce, and reinforce the solvency and sustainability of government spending programs, but a high rate of migration is not a cure-all for all economic problems. Below is a chart highlighting falling labour productivity as well as labour productivity’s correlation with household real wages/compensation. Canada will need to find ways to boost worker productivity, one of the primary drivers of household income growth, if it wishes to pull households out of recession and revive consumer confidence.

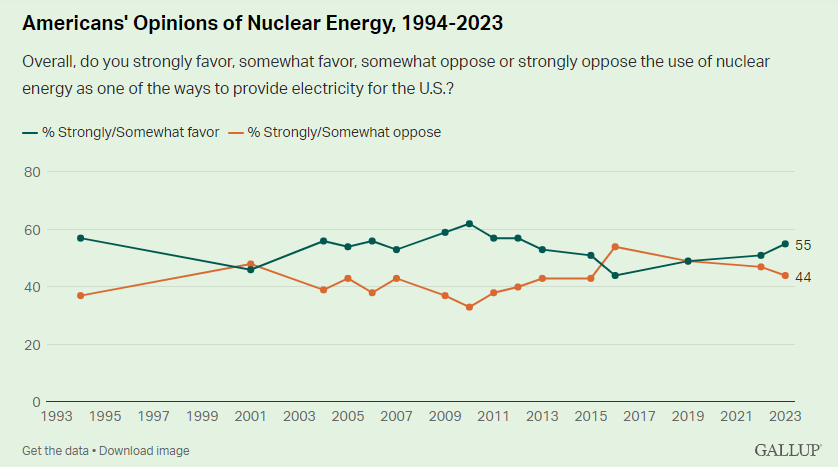

Uranium Prices Hit a 16-Year High on Demand and Supply Surprises. After being left for dead and falling below US$20/lb following the Fukushima disaster in 2011, uranium prices have ramped up in recent years, hitting US$100/lb for the first time in 16 years in January. Following the Fukushima disaster, many nations, most prominently Germany, vowed to halt building new nuclear power plants and/or close existing nuclear power plants as public support for nuclear power hit multi-decade lows. This weak outlook for nuclear power and uranium demand resulted in very little investment in new uranium mines. This negative view of nuclear power shifted in recent years as our collective expectations of achieving a low carbon, low emissions future meets scientific reality. Positive sentiment towards nuclear power in Europe was also pushed higher after Russia’s invasion of Ukraine. Minimizing Europe’s dependence on Russian energy became a high priority, and one that can only be achieved via nuclear power. On the supply side, uranium production is concentrated in just a few areas around the world and mines are operated by just a few major players, opening the door to possible production and production growth issues, as was noted in recent days by the world’s largest producer, Kazatomprom.

Our Take: Nuclear power is the only cost-effective way to achieve a low carbon, low emissions future in the scale necessary to meet our growing energy needs. Demand for uranium is bound to grow as carbon pricing creates an economic incentive to choose nuclear power over most other sources. European demand for uranium will be driven by an existential push to secure their future energy needs and reduce its reliance on Russia. While demand for uranium is likely to rise over time, the time it takes to build a new nuclear reactor combined with the time it takes to build a new uranium mine, will make it difficult to ascertain where uranium prices go over the coming years. Canada, second in the world in uranium production and third in the world in uranium reserves, is in a very good position to meet this growing uranium demand as a trustworthy and reliable trading partner and act as a key supplier to the US and Europe as they transition to a cleaner and more sustainable energy grid.

JUST FOR FUN

- Imagine calling up your contractor and using a spin on the classic adage ‘My dog ate my deposit!’. A Pennsylvania couple faced this reality when Cecil, their 100-pound doodle, consumed an envelope containing $4,000 in cash. Thankfully, the couple was able to recover $3,550 by sifting through Cecil’s waste, earning every dollar they recovered. According to the bank that accepted and swapped the recouped funds, this happens often, especially if the cash was used in the food industry. Life lesson – limit the amount of cash you bring to restaurants.

- You reap what you sow! Nicolas Puech, the fifth-generation heir of the Hermès fortune, plans to bequeath a large part of his $11 billion fortune to his 51-year-old gardener, whom he also intends to adopt. He must have been an excellent gardener! Someone call Adam Sandler as this sounds like the perfect “based on a true story script for Mr. Deeds 2”.

- Brian and Jeannine celebrate 25 years with Raymond James! Which means a quarter of a century partnering with clients like you, to help accomplish your lifetime goals and provide lasting legacies to your beneficiaries. The relationships and friendships that have formed are the motivating force that keeps them working hard for you. Here’s to celebrating many more anniversaries at Steele Wealth Management.