Now is The Time For 2023 Year-End Tax Planning!

Below you will find a link to a Raymond James tax planning publication that outlines important dates and actionable strategies to consider before year-end deadlines.

2023 Year-end Tax Planning Opportunities

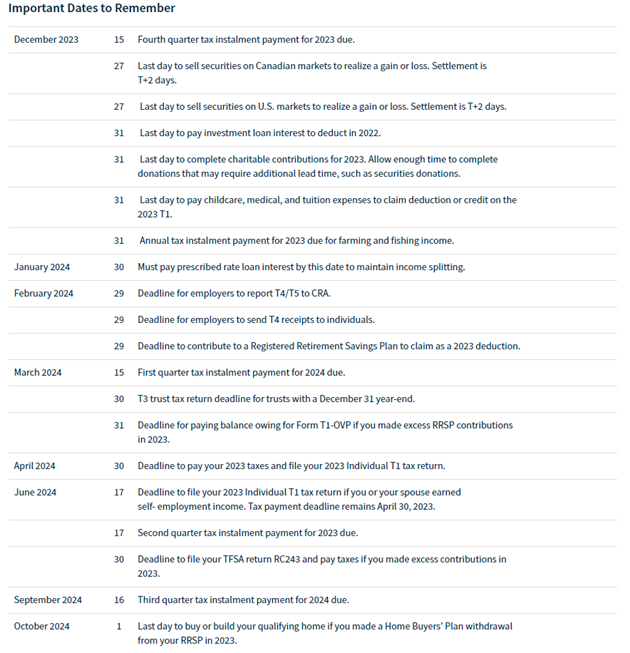

With 2024 fast approaching, now is an opportune time to implement tax planning strategies. While tax and financial planning should take place all year long, there are several actionable strategies to consider that can help you minimize your taxes and align your finances with your short- and long-term goals before year-end deadlines. These strategies are outlined in detail in the full publication.

Note that your Steele Wealth Management team reviews your investments in light of your goals, the tax policy environment, and the economic landscape to see where adjustments need to be made to position you for 2024 and beyond. During this review, we determine the best time to realize capital gains and losses as appropriate to reduce your overall tax liability.

We encourage you to look through the full publication to prepare for the upcoming tax season. Please reach out to us, or have your accountant reach out, if any clarification is required.

If you have a friend or family member who could benefit from the information provided, please feel free to pass it along or reach out to your Steele Wealth Management team.