SEQUENCE OF RETURNS RISK: UNDERSTANDING IT AND THE IMPORTANCE OF A SMOOTH RETURN EXPERIENCE

Sequence of Returns Risk: Understanding It and the Importance of a Smooth Return Experience

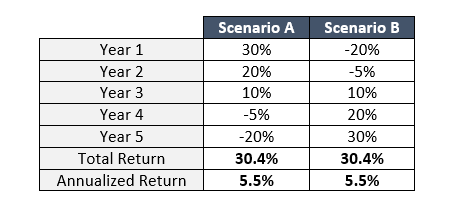

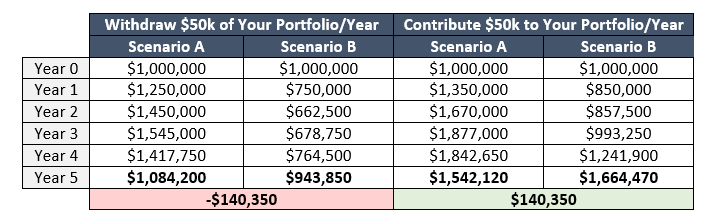

Sequence of returns (SOR) risk may be one of the least understood concepts in finance. Most investors grasp market risk, inflation risk or longevity risk and how these risks can influence their ability to meet their financial goals but few pay any mind to SOR risk. SOR risk comes from the order in which your investment returns occur, or in other words, the danger that the timing of withdrawals (or contributions) will have a negative impact on your personal rate of return. To put this risk in perspective, let us consider two five-year portfolio scenarios:

Investors who are neither withdrawing funds nor contributing funds from their portfolio will realize a total return of 30.4 per cent and annualized return of 5.5 per cent, irrespective of the order of returns. It is common to think of market/portfolio returns in this way, ignoring the sequence of returns and the effect of contributions or withdrawals. Now let us consider what happens when we make contributions or withdrawals.

In Scenario B, wherein portfolio returns are weak at the beginning of the sequence, there is material underperformance for the investor in withdrawal mode (red), but an equally material outperformance for the investor in savings mode (green). In the most basic sense, this means that near-term market declines are good for young savers and not so good for older retirees in withdrawal mode. This also highlights the importance of portfolio stability for those in withdrawal mode, especially in the early years of retirement.

How can investors in withdrawal mode break the sequence, limit overall portfolio volatility and therefore increase the predictability of investment returns and retirement income?

The easiest way to reduce SOR risk is to hold a truly diversified portfolio consisting of equities, fixed income and alternative investments that are either uncorrelated with or negatively correlated to each other. Holding a portfolio of securities wherein something is regularly performing well would help stabilize your portfolio value over time while limiting the odds of a large drawdown in portfolio value. So far, in 2022, equities and bonds have fallen in tandem – a historically rare phenomenon – but alternative investments have held up well, helping limit downside in portfolios that contain alternative investments.

A useful but less popular way to defend against SOR risk (because it means some lean spending years) is to establish dynamic spending rules. Withdrawing less in years the portfolio experiences a drawdown and withdrawing more in years the portfolio experiences above average growth can help reduce the effects of the sequence of returns. The “Are We On Track?” graph we generate using the results of your retirement projections and update at each client review meeting provides visual confirmation whether established after-tax income/withdrawal levels are sustainable. If needed, this chart could be used as the basis for a dynamic spending strategy.

SOR risk also highlights the value of planning ahead when using your investment portfolio to fund bigger purchases (e.g., houses, cottages, cars, large renovations, etc.). Raising cash to fund bigger purchases 12-24 months in advance, when markets are stable, is wise as opposed to waiting to raise funds close to the date of purchase, which subjects you to significant SOR risk.

At Steele Wealth Management, we aim to provide you with a smoother than average return experience, not only because it is a more tolerable investing experience, but also because it is financially beneficial, especially for our clients in withdrawal mode. While outright portfolio returns are important, risk-adjusted (e.g., volatility adjusted) portfolio returns tell the real story for retirees or those with near-to-medium term withdrawal requirements.

Economic Tidbits: Canadian Mortgage Rates Ramp Higher But Have yet to Cause Turmoil in the Housing Market

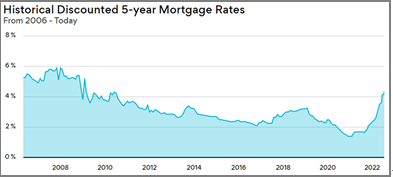

- The Canadian housing market is looking vulnerable for the first time in a long time, as the five-year discounted mortgage rate skyrocketed from 1.39 per cent in February 2021 to 4.34 per cent today. This is the highest mortgage rate since February 2009 and a level not truly experienced since before the 2008 financial crisis. In June, Canadian home sales activity was almost a quarter lower than June 2021, though remain in line with historical averages. The pace of new home construction and home renovations has also started to wane indicating that higher borrowing costs are starting to bite but both remain well above pre-pandemic levels. Higher mortgage rates may take time to significantly slow housing market activity because homebuyers and homeowners refinancing their mortgage have pivoted to variable rate mortgages, effectively postponing the impact of rising interest rates by three to six months (based on current expectations), and very few homeowners have had to refinance their mortgage at the now higher mortgage rates. If mortgage rates remain at current levels, the Canadian housing market and the Canadian economy may see its first prolonged downturn in decades.

Le JIT: A “Just-in-Time” Rundown of Our Current Investment Theme

EAFE Markets on Sale as Economies and Businesses Struggle with the Localized Energy Crunch

- Europe, Australia, Asia and Far East (EAFE) markets are particularly sensitive to shifts in energy prices as Europe and much of Asia are energy importers. If oil prices spike higher, the cost of doing business rises more than in North America and the amount of discretionary income available to households falls relative to North American households. The current energy price spike, caused by the conflict in Ukraine, has been particularly damaging for the European and Japanese economies due to the extreme dependence on and the boycotts of Russian energy products.

- The impact of high regional energy prices can be seen most clearly in currency movements. As of July 15th, the euro, British pound, Japanese yen and Chinese yuan are down 13 per cent, 14 per cent, 17 per cent and six per cent, respectively year-to-date, relative to the U.S. dollar. By comparison, the Canadian dollar is down only two per cent year-to-date relative to the U.S. dollar.

- Likewise, EAFE markets have underperformed North American markets in 2022. As of July 15th, in U.S. dollar terms, the iShares Core MSCI EAFE index (IEFA) is down ~21 per cent year-to-date while the U.S. S&P 500 and Canadian TSX composite index are down ~18 per cent and ~13 per cent, respectively.

- EAFE markets have long traded at a discount to U.S. markets, but the recent energy price spike has further exacerbated this discount. The MSCI EAFE index currently trades at 1.5x price-to-book value and 12.4x trailing price-to-earnings versus the S&P 500 at 3.5x and 18.5x. We think that if a recession or a partial resolution to the Russia-Ukraine conflict causes energy prices to wane, EAFE stocks are primed to outperform those of the U.S.

- The best way to play EAFE stocks leading into and during a European/Japanese recession is to buy quality companies that can weather a weak economic environment but can also perform well coming out of a weak economic environment. The Fidelity International High Quality Index ETF (FCIQ) is a great way to gain exposure to high quality but down-on-their-luck EAFE stocks.

Key risk points: Stocks, EAFE or otherwise, quality or not, are inherently volatile. If the energy price crunch continues, EAFE stocks could continue to struggle and underperform North American peers.

Jeannine’s Tip o’ the Month: Guiding Others the Way We Guide You

We would like to thank our clients for the trust and confidence you place in us. We are grateful for the opportunity to work with you to help fulfill your financial goals. If you have a friend or family member who could benefit from our services, we would be happy – and honoured – to offer them the same personalized attention and expertise we provide you. The best way to do so is to include your friend or family member and a member of our team in an email, introducing us to each other. Also, note that you may want to discuss our team and services with your friend or family member before making the introduction by email.