Second Quarter 2022: Where Have All The Cowboys/Girls Gone?

Investors That Once Had Light In Their Eyes in Their Support of Crypto Assets, Futuristic Stocks and Cannabis Stocks Have Gone Dark

Quarterly Summary and How We’re Positioning for Q3

Anyone who spent more than five minutes on Twitter in 2020 and 2021 asked themselves, “What’s up with all the shining Superman / Captain Marvel eyes?” Those laser eyes were donned by modern day cowboys and girls willing to risk it all to invest in a concept that many of them may not have fully understood but one that represented the future nonetheless. These laser eyed folks coalesced around new concepts like crypto assets but also tended to invest in other futuristic concepts like new technology and widespread cannabis legalization. Their enthusiasm was contagious and many of us regulars were encouraged by the technological advances and changes that lie ahead and how it may benefit us financially as well as on a day to day basis.

While Paula Cole’s 1997 hit “Where Have All the Cowboys Gone?”, now a mainstay of country and western karaoke bars, was about a lack of virtuous partners and the despondency that caused, it is hard for investors to not feel a bit like Miss Cole these days. The investing cowpokes that crowded the airwaves over the past two years are gone, or have at least gone radio silent, leaving a void. This void cannot be easily replaced with rational thought by rational thinkers as it’s truly a void of enthusiasm, something that is atypical of rational investors. This downgrade in enthusiasm not only affects the stocks and markets the cowpokes were most active in but all markets and potentially even economic growth as general gloominess can negatively affect consumer and business spending.

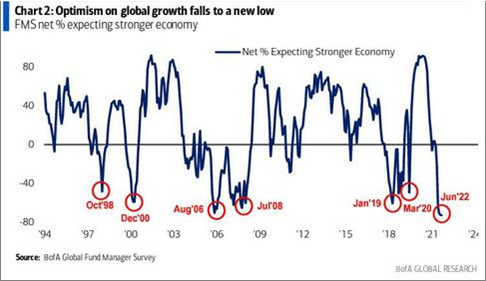

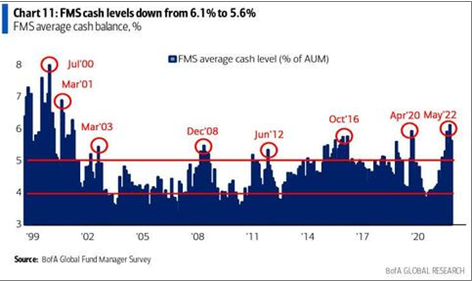

Bank of America’s Fund Manager Survey (FMS), a monthly report that canvasses the views of approximately 300 institutional, mutual and hedge fund managers around the world, indicates that even professional investors:

Are the least optimistic about global economic growth since the survey’s launch in 1994…

Have the worst corporate profit outlook since 2008…

And are sitting on the most cash, give or take, since 2001…

And right fully so, to an extent. Central banks have been rapidly raising interest rates around the world in their fight against high inflation, which is further exacerbating the economic stress caused by the high inflation itself. Since late 2021, economic data has taken a hard turn negative, painting a poor picture of our near-term future. The sugar high that the world economy was on following the unprecedented pandemic-induced global stimulus has turned into a hangover, and there doesn’t appear to be any more sugar on the way.

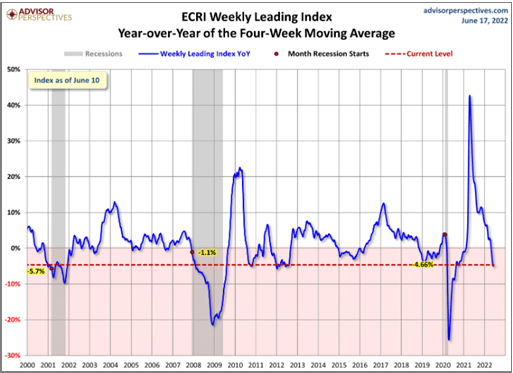

Rather than show numerous charts indicating that the economic outlook is weak, the Economic Cycle Research Institute’s (ECRI’s) Weekly Leading Index (shown below), clearly captures investors’ concerns. At current levels, the US economy is typically in or on the brink of an economic recession.

Surely not surprising given the commentary above, equities declined in Q2 to reflect the negative shift in investor expectations and economic growth, with the S&P 500, NASDAQ 100 and TSX composite indices falling 16.4%, 22.4% and 13.4%, respectively.

In the past, stock markets needed to have declined even more than they have to date in order to justify such extreme fund manager bearishness. The reason for this discrepancy could be the result of limited low-risk investment options so far during this equity market decline as fixed income has declined alongside equities, and in a historic fashion. This discrepancy may also be driven by the excess pile of low-yielding cash, created by central banks around the world over the past decade and a half, which must be held by someone (e.g. investors, banks, etc.) at all times. This excess cash increases market volatility as it heightens investor emotion and feelings about cash and equity markets. Not long ago, phrases like “cash is trash” and “there is no alternative (to equities for returns)” were commonplace, but so far in 2022, cash is clearly not trash (relative to equities and fixed income) and investors have clearly pivoted to the phrase “there is no alternative (to cash for capital protection)”. This highlights the heightened investor emotion of the past few years.

The current level of fund manager bearishness is typically seen as a bullish market indicator as a greater percentage of fund managers are likely to adopt a positive investment outlook than a negative outlook going forward and boost exposure to risk assets like equities, thereby pushing risk assets like equities higher in future. That said, given the lack of enthusiasm in the markets at the current time, we may need to see a positive catalyst to get investors back in the mood to take risk. A decline in the global inflation rate, or simply a decline in oil prices, may be enough to reignite investor fervor. A sufficient decline in demand due to high prices or a resolution to the Russia-Ukraine conflict may be what is needed to get the market out of its funk.

Finally, it is important to note that while equity market valuations have come down, they remain close to historical averages based on current earnings, they are above historical averages when pandemic related subsidies are removed, and a potential recession would likely cause earnings to decline. This means that investing in equities today is better than six months ago, we are not yet at historic buying opportunity levels, so a cautious approach may continue to be rewarded.

How To Position Portfolios Going Forward?

Generally, the portfolios we manage are down on the year but have weathered the equity market storm of 2022 well. While negative returns are rarely worth cheering about, outperformance relative to benchmarks has been noteworthy. Our overweight allocations to the defensive telecom, consumer staples and utilities sectors helped protect capital in the first half as these sectors were the three best performing sectors outside of the high flying energy sector. Depending on client risk tolerance and investment objectives, many of our portfolios contain alternative investments which have held their ground in 2022. While fixed income also performed poorly so far in 2022, we see performance beginning to improve in the second half as slowing economic growth could ease inflation pressures and push interest rates down, and bond prices up. We remain committed to maintaining a diversified portfolio of equities, fixed income and alternative investments, adjusting along the way to rebalance portfolios (i.e. take some profits on winners, shore up any losers that maintain a strong outlook).

While equity market valuations remain average to above average, depending on how you look at them, the equity market decline has opened up opportunities for specific sectors and stocks. Our top priority within our equity sleeve is capturing profits on defensive stocks that now have limited upside potential and reinvesting the proceeds in stocks that have declined significantly during the equity market downturn, and now have much more upside potential.

The consumer discretionary, industrials, financials and real estate sectors are down as investors have begun to price in a potential recession in 2022 or 2023. Select stocks in these sectors could outperform going forward if the recession is shallower or shorter than expected. One stock that stands out in this bucket is Great-West Lifeco (GWO) whose valuation has fallen to the low end of its historical trading range, despite operating a utility-like financial services business.

Many stocks in the technology sector, while generally not seen as overly cyclical, have declined as a result of rising interest rates and weak investor sentiment. Last quarter we provided a shortlist of five monopolistic, high growth stocks including DocuSign (DOCU), Zillow (Z), Zoom Video Communications (ZM), Illumina (ILMN) and Uber (UBER) which could perform particularly well during and coming out of a recession. Stocks like Alphabet (GOOG) and Amazon (AMZN) could also perform well during and coming out of a recession if supply shortages turn into a supply gluts and retailers ramp up advertising and discounting to move product. When the cowboys and girls return to equity markets, they will likely return to the horses they rode in the past, many of which were technology names with multi-decade growth outlooks, like those listed above.

In the fixed income sleeve, we have tilted more heavily toward long-term bonds, as these bonds will likely rise the most during a recession (or weak economic environment), offsetting potential further equity market weakness. We have also started to selectively add GICs to portfolios to boost income and reduce portfolio volatility. One-to-five year GIC yields are currently 4%-5%, the highest they’ve been since 2007.

Alternative investments continued to do what they were designed to do in Q2, posting positive returns on average, offsetting weakness experienced in the equity and fixed income sleeves. The odds of a recession appear to have risen (more so in Europe, Japan and emerging markets, less in North America) so maintaining a material allocation to alternative investments remains prudent. If alternative investments continue to outperform equities and fixed income, we may look to rebalance asset allocations to get the alternative investments allocation back to target and invest in equities and fixed income at opportune prices/valuations.

As always, we are working constantly to position your portfolio appropriately to maximize return, while managing your overall portfolio risk exposure. Please feel free to reach out if you have any questions or concerns.

Sincerely,

Steele Wealth Management