BIG TAX REFUND? BIG TAX MISTAKE! STOP LENDING TO THE GOVERNMENT FOR FREE

If you were to buy a car and a few months later realize you overpaid, would you feel positive feelings about the rightful refund you received, or would you just feel like you got what you were entitled to? Getting a tax refund is akin to getting a refund on virtually anything else. Despite the words being same, many people tend to have a ‘lottery win feeling’ toward a refund of the tax kind, likely because you didn’t feel entitled to a refund before you were aware of it or because of the feel good and funny marketing associated with tax refunds. But don’t be fooled!

With tax filings in the rearview mirror, it is time to assess how we did. For many, the ‘how we did’ depends on how big of a tax refund we received. It is hard to feel bad about receiving a large amount that we perhaps did not quite expect. That said, receiving a large amount from the CRA should be seen as a bad thing, unless that large amount was due to a last minute RRSP contribution or other last minute tax deduction, in which case it should not be surprising. The money we receive as a tax refund is and was always our money so allowing the government to hold onto this money throughout the year equates to an interest-free loan.

Interest Free Loans to the Government Are No Longer Inconsequential

Over the past five to ten years, we lived in a world of interest-free high interest savings accounts (HISAs) and GICs yielding 0.5%-2.0%. Bestowing the government an interest free loan in this environment was less of an issue, especially if you were going to keep that money in cash or low risk securities anyway. Now that investors can generate ~1% in HISAs and buy two to five year GICs yielding 4%+, the opportunity cost associated with these interest free loans is meaningful.

How Do I Reduce the Size of the Loan I Provide the Government Each Year?

If you are employed, your employer will collect tax on behalf of the government, directly from your paycheque. Some may not know that you can provide your employer with completed federal and provincial forms ‘TD1, Personal Tax Credits Return’ and your employer may reduce the amount of tax withheld each year to better match your expected taxes payable at year end. Employees can include tax credits like the Canada caregiver and eligible dependent amounts, the spouse or common-law partner amount and the tuition amount to reduce taxes collected by one’s employer throughout the year. Pensioners can provide a completed form TD1 to benefit/pension payers to include tax credits like the age amount and pension income amount to reduce taxes collected throughout the year.

The more money you have working for you, the less time it takes to achieve your goals. Not loaning the government your money each year could result in you being able to retire earlier or you being able to leave more for your loved ones after you are gone.

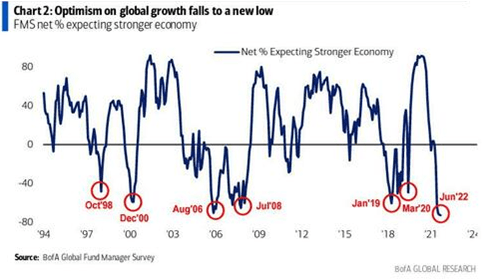

Economic Tidbits: bank of America FMS survey shows investors are nearly as bearish as can be

- Bank of America’s Fund Manager Survey (FMS) shows that professional fund managers are the least optimistic about global economic growth since the survey’s launch in 1994, have the worst corporate profit outlook since September 2008 and hold the most cash since 2001. While extremely bearish fund manager positioning and a weak fund manager outlook is often seen as a contrarian bullish indicator for stock markets, and stock markets have fallen therefore reflecting some of this conservative positioning and weak sentiment, in the past stock markets have declined more than they have to date to justify such extreme fund manager bearishness. The reason for this discrepancy may be driven by the excess pile of low-yielding cash, created by central banks around the world, which must be held by someone (e.g. investors, banks, etc.) at all times.

Le JIT A “Just-in-TIME” rundown oF our current investment theme

Payment Stocks Beaten Up By Crypto Endeavours but Long-Term Outlook Remains Favourable

- The likelihood of a recession continues to grow, particularly in Europe and emerging markets, as high commodity prices and rising interest rates push the cost of doing business higher. Investors have favoured stocks in the cyclical energy and materials sectors as well as defensives and have shunned (to put it lightly) high growth stocks with strong long-term growth outlooks. High growth stocks generally saw significant gains throughout the post-pandemic bubble period but have since given up all of those gains and then some. Some high growth stocks are trading at 5-7 year lows despite their businesses since growing several times over.

- In April, we highlighted a number of monopolistic high growth stocks – DocuSign (DOCU), Zillow (Z), Zoom Video Communications (ZM), Illumina (ILMN) and Uber (UBER) – that will likely be able to continue growing top-line revenues throughout a recession and whose valuations are at their lowest in years. These ‘stay-at-home’ stocks have continued to sag as they experience some post-pandemic uncertainty and as investor sentiment has continued to wane.

- Other stocks that look interesting are high growth payment stocks, such as PayPal (PYPL) and Block (SQ) that got caught up in the crypto asset hype and have experienced a similar boom-and-bust fate as the stocks listed above. While we are not crypto asset enthusiasts, there is an okay chance that blockchain technology becomes more relevant in the coming years and PayPal and Block both facilitate crypto asset transactions, allowing investors to attain exposure to that particular market without investing in crypto assets directly. If crypto asset adoption and transactions grow over time, PayPal and Block are positioned to participate in that growth, in addition to the growth of their more traditional payment networks.

Key risk points: These stocks are more volatile, are perceived to be more risky than average and tend to decline more than equity market indices during downturns. All of these stocks derive the majority of revenues from the US.

Jeannine’s Tip O’ The Month: Welcoming Back Senior service assistant Kelly Edmonds!

After taking some time off to spend with her newborn baby, Kelly will be returning to full-time work in July. For those of you who have communicated with Kelly in the past regarding your accounts and other concerns, feel free to reach out to her. For newer clients who may not have had the pleasure of meeting Kelly, she has been with the team since 2004 and is a master of all things client service at Steele Wealth Management.