Talking Alternatives with Som Seif, CEO of Purpose Investments

Steele Wealth Management’s Sam Ryder discusses alternative investments with Som Seif, founder and CEO of Purpose Investments, co-founder of Wealthsimple, and founder of Claymore Investments, which was ultimately sold to Blackrock iShares.

Below is a clip of Sam and Som discussing private asset markets and how Purpose is leading the push to make alternative investments more accessible to investors saving for retirement and other financial goals.

You can watch the full video below.

News and our views

Israel-Iran Cold War Turns Hot, Putting Energy Markets On Edge. Following stalled nuclear negotiations between the U.S. and Iran and reports by the International Atomic Energy Agency that Iran has amassed a record amount of military-grade enriched uranium, Israel launched a military operation to dismantle Iran’s nuclear weapons capabilities, something that Israel sees as an existential threat. Iran quickly responded and the two nations are now in a tit-for-tat battle despite nearly one thousand kilometres between them. Oil and natural gas prices spiked on the news as investors are now concerned about potential attacks on energy production and infrastructure. Higher energy prices and heightened political and economic uncertainty caused stock markets to initially fall but they have since priced in limited lasting impact on Middle Eastern energy assets and an eventual resolution to the conflict.

Our Take: While we are still less than a month into Israel’s escalation, this appears to be the broadest direct conflict between Israel and Iran in decades. The targets attacked by Israel go far beyond nuclear facilities and include oil and gas fields, oil and gas refineries and political institutions. On top of physical damage to facilities, the odds of new U.S. sanctions against Iran have risen, which could also impact Iranian oil and gas production (the effect of past U.S. sanctions is shown in the chart below). Despite ample oil supply capacity available to meet oil demand, primarily within OPEC+, this conflict increases the risk of acute shortages and could result in higher-than-expected oil prices in the coming months. Higher demand due to the summer driving season and refilling of the U.S. strategic petroleum reserve (SPR), something President Trump has pledged to do with the SPR at a 42-year low, may further widen the possible acute gap between oil supply and demand. This could mean higher gasoline prices at a time when gasoline demand is at its highest which could reignite inflation fears and negatively impact consumer confidence globally.

Just for fun

- This month, under the guise of holding an annual team meeting, we were fortunate enough to coax Kelly Edmonds, a long-time SWM team member currently on maternity leave, to a local restaurant to celebrate her birthday. Her birthday gift? A full-day annual team meeting, but also a piece of cake! As we’re sure you’re happy to know, Kelly will be back with us full-time in the fall.

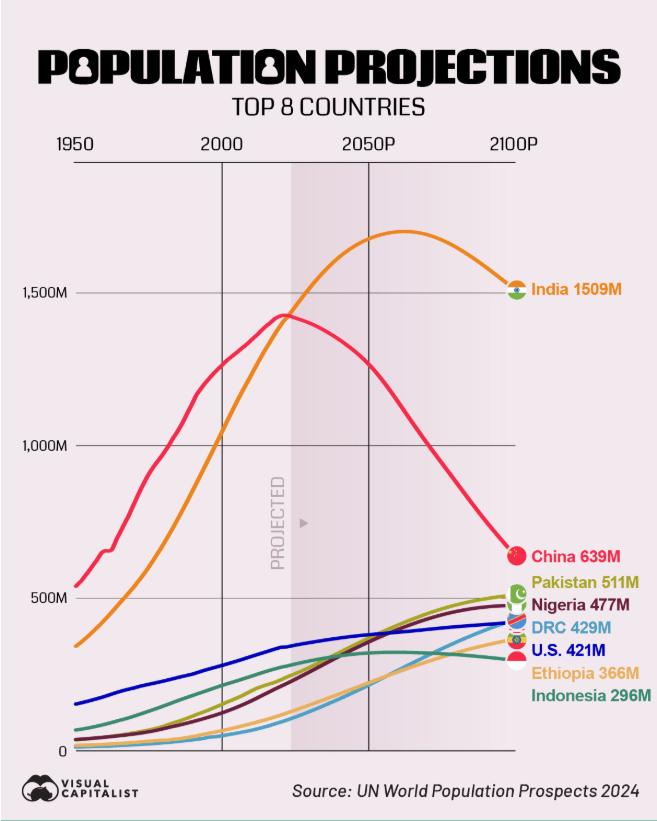

- A great visualization of how the populations of the eight most populous countries are expected to evolve as we enter the age of global depopulation.