The Evolution of Financial Advisors

Over the past few decades, how we work with clients has evolved for the good. Clients have never had more information available to them nor have they ever had a better vision of their financial goals and their ability to achieve those goals. Many of the “newer” financial services like financial planning, income planning, tax planning, and philanthropic and estate/legacy planning serve near-term goals but ultimately help clients remain focused on their long-term goals.

At Steele Wealth Management, we have built a 11-person team to lead in this evolution. Our team of investment management, financial planning and tax professionals offers our clients a pension-style investment approach while providing all the financial services of a family office. Our mission is to fully understand your financial life so that we can plan for and invest to achieve your life vision. Planning, whether it be financial, tax or estate, is an ongoing process that requires regular tracking to determine if we remain on track to achieve each goal, and we ensure affirm in each review meeting where we’re at in terms of achieving your stated goals. We believe using an all-encompassing approach with regular monitoring is the only way to ensure that your finances are properly cared for and provide you with confidence that your goals will be achieved.

Clients typically maintain all their investment assets with us to ensure all assets have oversight and are working toward achieving their long-term goals. Doing so can help ease financial stress, especially during volatile times, and keep investors focused on the long-term. If you have funds outside of Raymond James that are not being managed in alignment with your planning work with us, please feel free to reach out to have us aid in transferring-in these accounts.

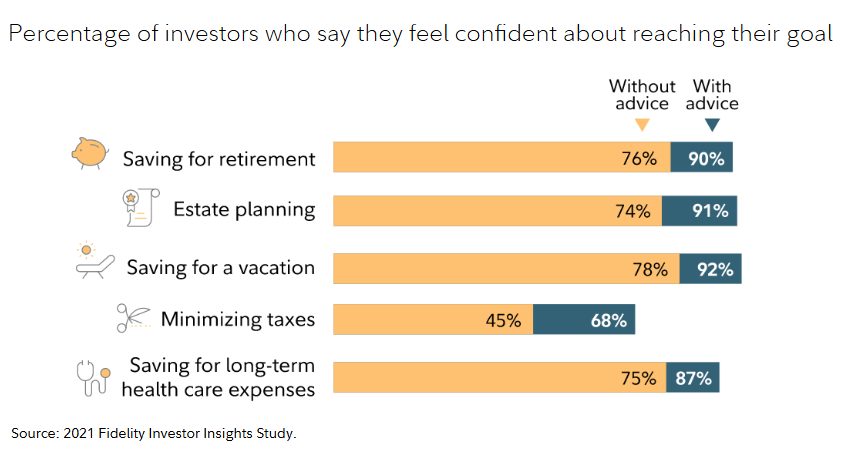

Focusing on long-term goals can help clients avoid anxiety in times of financial market volatility, anxiety which can result in hasty actions and adverse outcomes. Below we can see the value that advisors offer in terms of providing peace of mind by addressing the nagging concerns that keep you up at night.

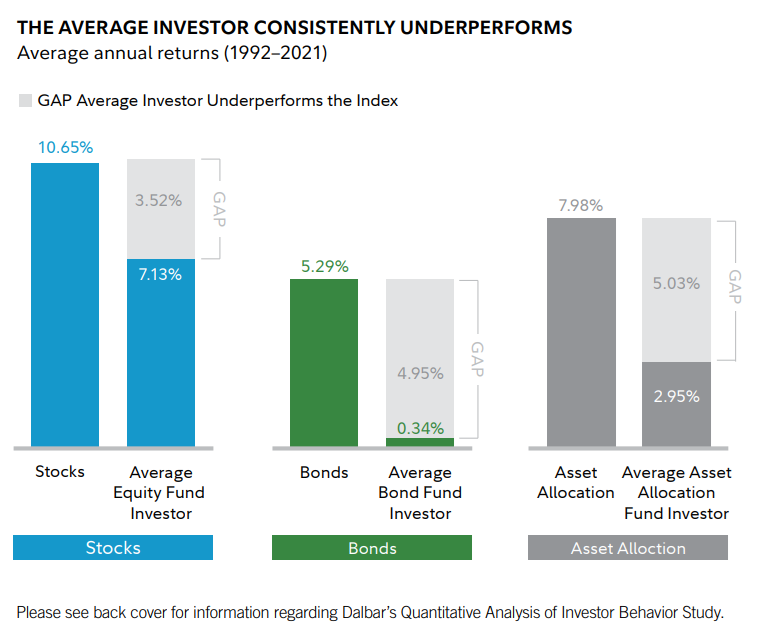

Further illustrating the impact of advice, below we see the returns of US stocks, bonds and balanced portfolios versus average investor experiences from 1992-2021. The disparity between the return of each asset class and the return of investors is largely driven by ill-timed changes to portfolios driven by emotional responses to market movements. These gaps in performance can add up over time and result in returns that are well below those who stick to the long-term plan, possibly putting the achievement of your financial goals in jeopardy. Advisors can help keep you focused on the long-term and avoid turning an emotional response into one that can damage your financial future.

In no way are we undermining the distress that market declines can have on one’s psyche. Seeing portfolio values decline alongside broad markets can be stressful for anyone. There are numerous studies, like these (1, 2), validating that equity market turmoil broadly creates strong emotions/feelings of anxiety and depression among investors, and evidence shows that factors like income or overall net worth have little value in terms of mitigating these negative emotions/feelings.

If you feel these types of emotions/feelings when markets are acting wildly, you’re not alone. And to be fair, nearly all of the media we consume during periods of market distress do us no good because their goal is to amplify these emotions/feelings to keep us engaged.

We are often the first call in the fact of financial stress as we should be. We are always happy to help in any way we can, be it by providing perspective, reviewing your “Are We On Track?” report to ensure you are in line to meet your long-term goals, adjusting your plan for life changes if necessary, or providing additional coping resources such as those in the link below.

This is very much in line with one of our passions at Raymond James in Waterloo: giving time and resources to support mental health. For the last seven years we have sponsored the Westmount Oktoberfest Charity Pro Am Golf Tournament for the benefit of the Waterloo Region Suicide Prevention Council and Lutherwood/Starling Children’s Mental Health. This is a cause that is close to our hearts.

If you or someone close to you is struggling and needs a hand, reach out to someone if you are able. The links below contain some readily available public resources if you need them.

Click Here for Mental Health Support and Resources for All

Click Here for HeadUpGuys, the World’s Leading Men’s Mental Health Resource

If you have any questions, please feel free to reach out to the team.

News and our views

Introducing Criselle Tung. We are excited to welcome Criselle Tung to our team!

Criselle Tung brings extensive expertise in accounting, finance, and auditing to our team. She holds a Diploma in International Financial Reporting and in 2021 she successfully completed the Financial Services Program at Conestoga College. She is also licensed to trade fixed income and equity securities.

Originally from the Philippines, Criselle earned her Bachelor of Science in Accountancy and holds the Certified Public Accountant designation. Her professional career spans nine years, during which she worked with several prominent local and international companies, gaining invaluable experience and insights.

Beyond her professional accomplishments, Criselle has a zest for life. She is passionate about exploring new cuisines, enjoying great coffee, soaking up the sun on beautiful beaches, and embarking on exciting travel and adventurous experiences.

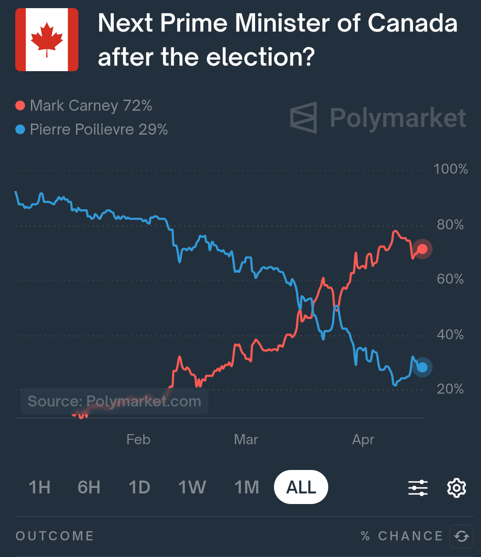

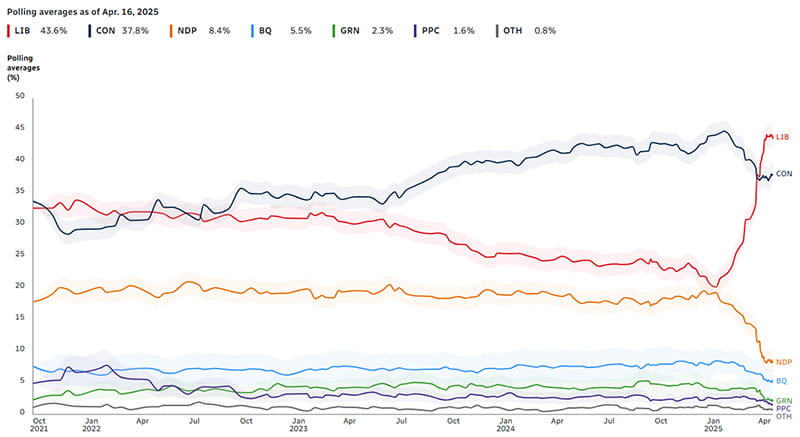

Canadians Head to the Federal Election Polls on April 28. Canadian federal election day approaches and the Liberal party has maintained its lead in the polls. The election race so far appears to be a two-horse race with no other party carving out any meaningful slice of the ‘voting intention pie’. This is to the benefit of the federal Liberal party which often splits the left-leaning vote with both the NDP and Green parties.

Our Take: The shift in sentiment toward the federal Liberal party has been a sight to see. According to polling averages, the federal Liberal party had as little as ~20% support as recently as January 2025 but now its support is closer to ~44% by changing the face of the party and addressing Canadian pain points like excessive immigration rates and the consumer carbon tax. Likeability of each party leader may be a key factor – Carney is widely favoured over Singh and Blanchet on the left, and Poilievre has suffered likeability issues in general – but Trump’s aggressive trade approach may be the overwhelming factor. The threat of U.S. tariffs, and the expected Canadian response, has pushed acting PM Carney into the limelight and into the role of defender of the Canadian economy, Canadian jobs and Canadian pride.

Here is an issue-by-issue summary and comparison of each party’s election promises and platform.