Trump’s Trade Tirade Turns Tangible – Extended Version, with More Charts!

We understand how exhausting and overwhelming the constant talk of tariffs can be. The news in 2025 has been particularly unsettling, and we want to acknowledge the frustration and uncertainty you may be feeling. You're not alone in this.

The situation remains fluid, with no clear resolution in sight. The lack of defined objectives from the current US administration has left many nations – and markets – grappling with uncertainty. We won’t del

Equity markets initially brushed off tariff threats and the first volley of tariff authorizations, but equity markets brush them off no more. The growth-heavy Nasdaq index experienced its worst day since 2022 in early March and other stock indices have also performed poorly in recent weeks. Let’s be clear, while the decline is noted to be drastic and quick, even for the worst hit of all indices – the Nasdaq – we can see that the decline has so far been a bump in the road when we zoom out (2-year return for the Nasdaq is shown below).

Adding to the general uncertainty is the Trump administration’s Department of Government Efficiency (DOGE) initiative, which is resulting in declining federal government employment and is increasing the likelihood of a quasi-engineered US recession. While economic uncertainty, shaky equity markets and falling employment aren’t great signs in the short-term, these factors have increased the odds of interest rate cuts in many nations around the world (to guard against softer GDP growth) which could make some products and services cheaper and help stimulate the economy, so not all short-term uncertainty is necessarily bad (that is our glass-half-full comment).

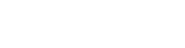

Fear and uncertainty are the talk of the town and investors often make the biggest mistakes during periods of fear and uncertainty. The VIX, broadly viewed as the US stock market’s volatility/fear index, hit a multi-year high (using end of day values) this week, highlighting that fear is rampant (though well below the 2008 and COVID highs) and some investors may be making irrational choices now, like selling stocks that are down for no fundamental reason. It is also important to note that while professional investors like hedge fund and pension fund managers flock to buy put options to protect their portfolio (which is reflected in the VIX), bond investors, who are more long-term in mindset are unbothered by the threat of tariffs and the DOGE initiative. As we can see from the chart below, the VIX (blue line) has popped to a multi-year high, but the Bank of America BB US High Yield Index (red line), which measures default risk of US companies most vulnerable to tariffs and recessions, has barely budged and remains near all-time low levels of concern. Clearly the recent market turmoil is an equity market related issue and not one that is considered a true long-term economic issue, for now at least!

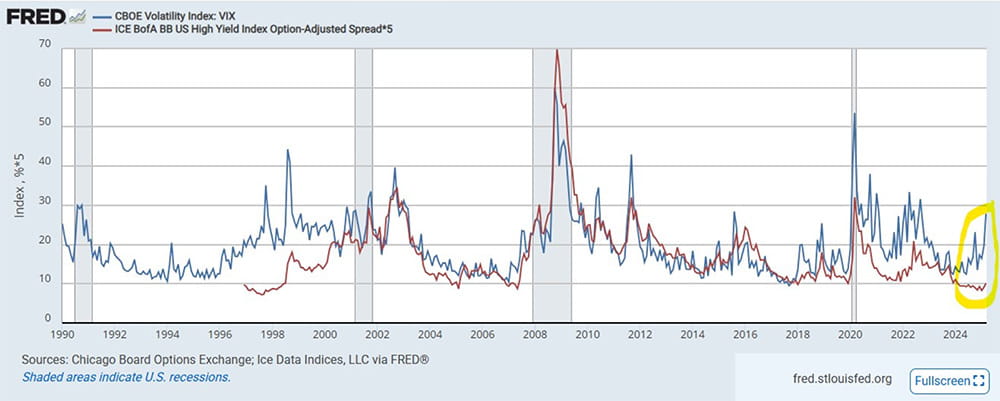

At Steele Wealth Management, part of our job is to help keep you focused on achieving your long-term financial goals. Not getting distracted by short-term volatility is an important part of that process. As the chart below shows, moments of equity market downside are a normal part of investing, and equity markets have proven that they can weather every storm thrown at them, with enough time of course. “This time is different” is something we’ve heard several times these past few weeks, and we agree, every time is different, but the differents are always more the same than different. The conditions and contexts may change, but the way we humans behave does not.

The S&P 500 (US Stock Market) Versus Continuous Crises.

On a more personal level, it is important to remember that what happens to equity indices like the Nasdaq or S&P 500 is not necessarily what happens to your investment portfolio. Maintaining a broadly diversified portfolio, both from a geographical and asset class standpoint, can help limit downside in situations like the one we face now. Even better, equity market downside can provide unique opportunities for well diversified investors who can capitalize on lower stock prices fashioned during moments of fear.

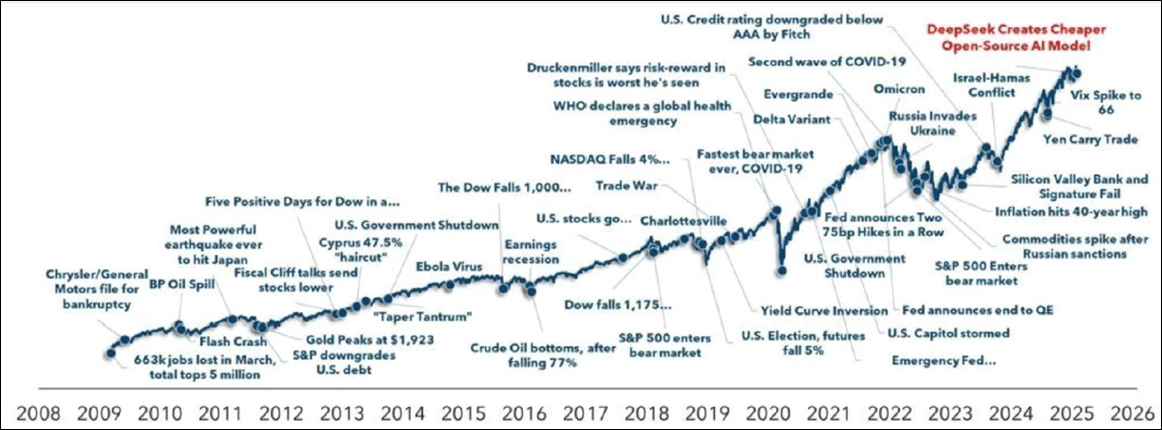

After a tech sector boom that has lasted over a decade, it is easy to forget that in the 1970s, half of the 1980s and from 2000-2013, international markets (including Canada) outperformed US markets in a significant way. Below we see periods of US versus International equity market performance since 1975.

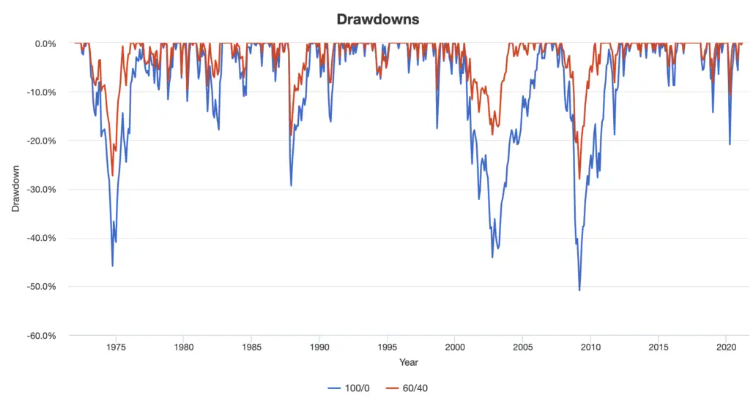

After a period wherein bonds and equities were highly correlated because rising interest rates negatively impacted equity markets (2021 to 2024), it is easy to forget that historically, bonds (and alternative investments for that matter), have reliably limited downside during US-led equity market downturns. Below we see how a portfolio of 60% US equities and 40% US bonds (red line) declines far less than a portfolio of 100% US equities (blue line) during major downturns. Investors can pivot from bonds to equities during these periods to help outperform relative to a 100% equity portfolio as well. Further, international equities tend to outperform during periods of US equity market weakness so a globally diversified portfolio is expected to provide even more protection during equity market downturns and provide more opportunities to pivot from investment to investment (i.e rebalance portfolios).

Prudence Begets Patience. Patience Begets Opportunity. Opportunity Begets Outcome. Turmoil must first be met with prudence, or outcome may be difficult to achieve. In other words, diversification creates its own opportunity and rebalancing captures this opportunity, leading to positive outcome.

As always, if you have any questions or concerns, please feel free to reach out to the team.

News and our views

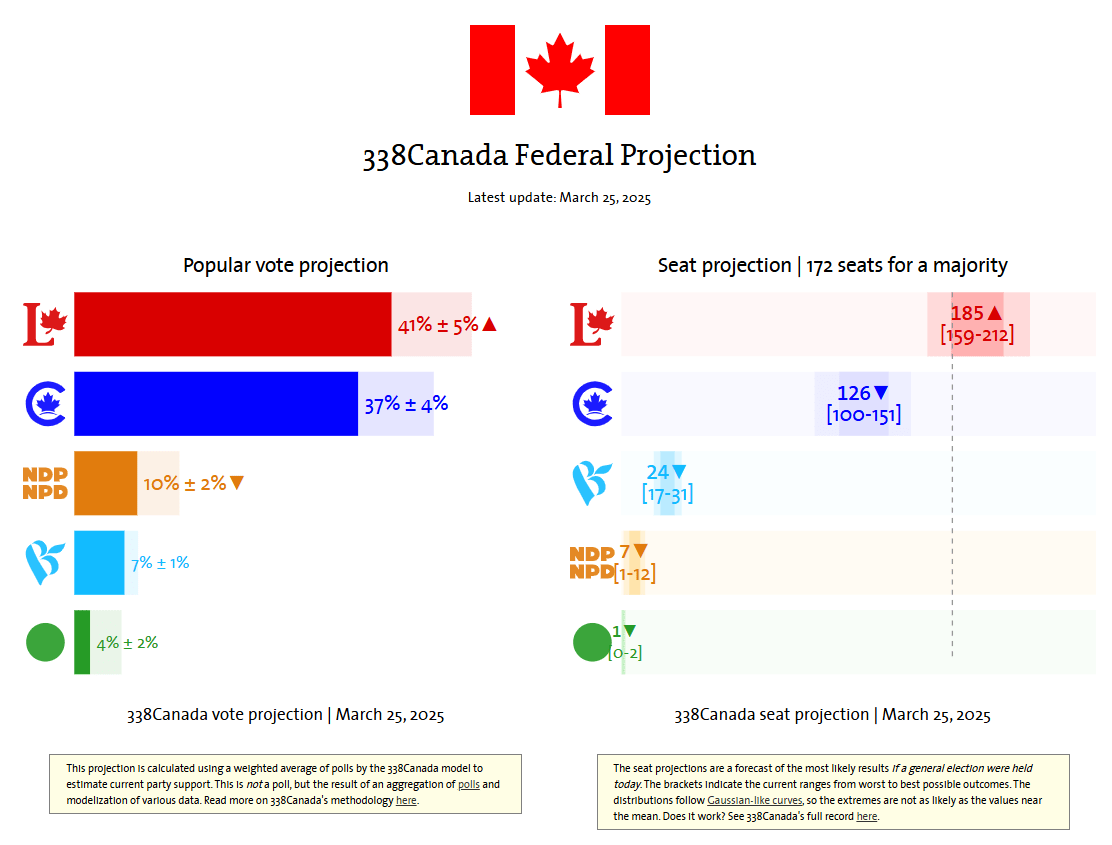

The Race Is On! Canadian Federal Election Campaigns Ramp Up Just One Month to Election Day. On March 23rd, one day before Parliament was set to reconvene after being prorogued by former PM Justin Trudeau, standing prime minister Mark Carney called a snap election for April 28th. All political parties had made their intention clear that they would support a motion of non-confidence of the current Liberal government when Parliament was resumed, making a snap election all but guaranteed. Official polls have the Liberal party well in the lead in terms of overall support and projected seat count. The Liberals have benefitted from greater visibility due to the party’s month-long leadership race in early 2025 as well as a tariff-obsessed Trump administration reigniting a sense of national pride, causing voters to coalesce around Canadian federalism, a concept championed by the Liberal party, rather than separatism.

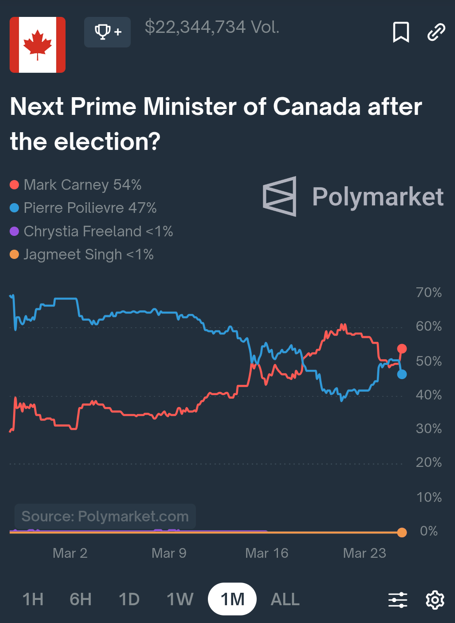

Our Take: Despite the strong support highlighted by recent polls, it is still far too early to make any assumptions about what a future federal government will look like. Due to the Liberal leadership race, that particular party has dominated the airwaves for much of 2025, with little audience provided to other party leaders. Now that the election has officially begun, we can expect to see a louder and more unified challenge against the incumbent Liberal government which may affect polling from now until election day. Polls can often be incorrect due to sampling error, institutional bias or various other reasons. Prediction markets can tend to be more accurate since there are no sampling errors or institutional bias, and money is at stake in those markets. During the 2024 US presidential election cycle, polls showed that race as a 50/50 contest while prediction markets had Trump winning with 2-to-1 odds leading up to election day. We all know how that one went! When it comes to prediction markets for the Canadian federal election, we see a 50/50 contest rather than a blowout, which is currently indicated by the polls. Something to keep an eye on as we approach election day…

March is Fraud Prevention Month – Video with Steele Wealth Management’s Laura Prust. Approximately one in five Canadians have been approached with a possible investment fraud, according to the Investor Survey conducted by the Canadian Investment Regulatory Organization (CIRO). During Fraud Prevention Month, CIRO spotlights the importance of protection against account intrusion scams.

How does Raymond James help protect you against cybersecurity threats to your financial information? Learn more about how we benefit from our strategic partnership with Raymond James Financial, along with tips to help prevent falling victim to fraud/scams that affect many Canadians in our March TSWS video.