Do You Own Businesses or Stocks? There is a Difference…

The Oracle of Omaha Warren Buffett is well known for conveying strong and proven messages about investing in simple ways that many investors tend to forget, especially during market booms.

“It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

“Price is what you pay. Value is what you get.”

“Time is the friend of the wonderful company, the enemy of the mediocre.”

As a long-term investor, Buffett views himself as an owner of businesses rather than a temporary shareholder. In some cases, he will buy an entire company (e.g. GEICO, Burlington Northern Santa Fe, Dairy Queen) and in other cases will buy 10% or so of core businesses with strong track records and outlooks (e.g. Coca-Cola, Bank of America, Apple). Buying a business outright and buying a piece of that business is effectively same, albeit with a smidge less control in the latter case. Buffett buys high quality and time-tested businesses (those that have weathered time), ones he knows well (hard to know everything well) and ensures the businesses he owns are well managed over time (bad management can kill a good business). This helps ensure that the direction and outlook of the businesses he owns align with his long-term investment time horizon and are businesses that can weather the ups and downs of market speculation and different business cycles.

If you’re Warren Buffett or a long-term investor saving for retirement, why is it important to stick to your long-term game plan of buying strong businesses? Because it is easy to get swept up in the madness that every market cycle brings. Whether it’s the dot-com bubble or mortgage companies in the 2008 bubble or work-from-home stocks during the COVID-19 bubble, the market will present a number of new companies that don’t necessarily have strong businesses to support their stock values or even their long-term viability as a business. Over 100 years ago, Jesse Livermore, widely regarded as the greatest trader in history, highlighted that investors in a speculative/bubbly market will continue to search for new stocks to speculate in, irrespective of whether there are good businesses to support the stock price. 100 years ago!? Even with an extra 100 years of history proving Livermore’s statement, investors often get fooled by new ideas that pop up during speculative periods.

Below are Warren Buffett’s returns since 1965 relative to the S&P 500. As we can see, Buffett has outperformed the most widely followed index by almost 10% per year (mind you this chart is from Buffett’s inception in 1965 to 2023) but very little has changed since then. Over time, focusing on businesses rather than the hot new thing that the market is feeding to speculators pays off and the chart below validates that point well.

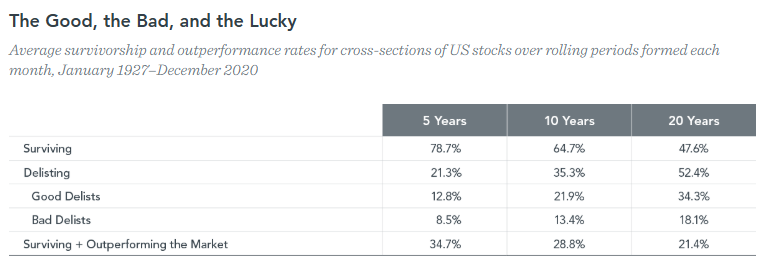

Below we see the failure rate of US stocks over any 20-year period is ~18% (‘Bad Delists’/Bankruptcy) while many of the ‘Good Delists’ amounting to ~34% of all stocks also didn’t have necessarily have good return records (business may have been in distress and agreed to sell). Living through the dot.com boom, it doesn’t take a rocket scientist to see how many of these stocks got into trouble (hint: many didn’t have strong business and instead had okay marketing departments at the time!).

What about investors focused on high quality and time-tested businesses? Albeit with some short-term volatility and uncertainty over time, they generally weathered these speculative moments and difficult business cycles just fine and, in most cases, the underlying businesses continued to grow as smoothly as expected, if not emerge stronger due to their greater resources than the newer, less proven businesses. Many of Buffett’s businesses have lasted far beyond 20 years, further reinforcing the basis to allocate to time-tested businesses. Above we see that almost 50% of businesses that survive over 20 years outperform the market while nearly 50% underperform. While this doesn’t seem too impressive, the survival of the ~50% of underperformers alone, as opposed to total or near total loss experienced by bad and some good ‘delists’ preserves capital and allows it to continue growing in favour of long-term investors. It is tough to grow $0 into something more than $0!

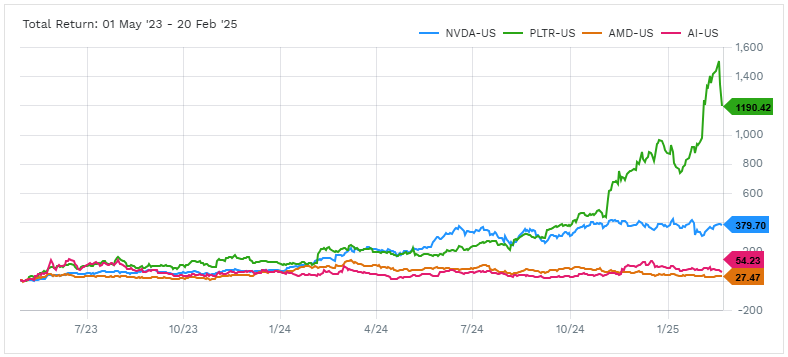

Looking at today’s environment, artificial intelligence (AI) has captured the hearts and minds of investors around the world. Some stocks, Nvidia (below in blue, NVDA) and Palantir (below in green, PLTR) being the prime examples, have seen revenues and earnings improve greatly over the past 2 years at least somewhat justifying the strong stock performance since the AI boom began. Other stocks, such as AMD (below in orange, AMD) or 3Cai (below pink, AI, with the stock ticker ‘AI’ to drive investor attention to it) are major AI stocks that haven’t fulfilled their mission and have already seen the hype largely dissipate as their lack of strong AI growth or weak management has been exposed. It is likely to the benefit of most long-term investors to be wary of any stock whereby AI hype is the primary allure.

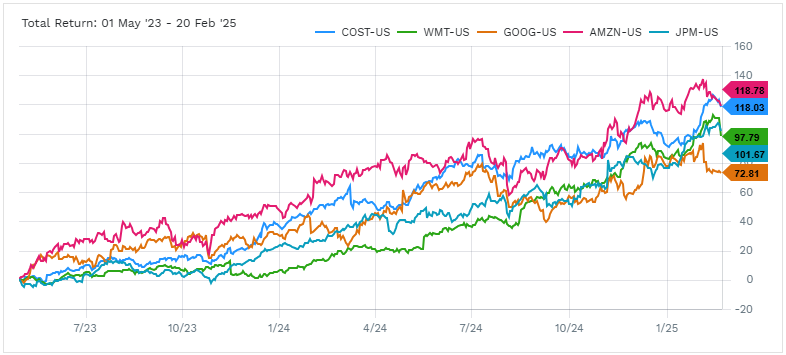

On the flip side, let’s look at strong businesses with proven track records over the same time period including Costco (COST), Walmart (WMT), Alphabet (GOOG), Amazon (AMZN) and JP Morgan (JPM). Steady ride higher with little participation in AI, no need to pick the winners and avoid the losers of the boom and if the AI boom does eventually start to fizzle, these stocks will likely do much better than the speculative AI stocks above. Smoother ride and more predictability.

While AI hype may present a distraction for long-term investors, there are select businesses participating in the AI boom that are often overlooked because they aren’t pictured on the ‘AI Stock 2025’ movie poster. In addition to those that are participating in the AI boom, there are many businesses that are not participating but continue to operate their businesses and grow as expected but largely under the radar. While market noise and short-term disruptions are inevitable, they do not change the inherent value of well-run businesses with strong fundamental outlooks.

Steele Wealth Management utilizes that ‘Buffett approach’ daily, thinking long-term for our clients who are saving for retirement, in retirement or looking to achieve other long-term goals. Opportunities to participate in trends or boom arise from time-to-time but one must always view these opportunities through the lens of buying and owning businesses that will benefit from not just today’s trend, but tomorrow’s as well.

News and our views

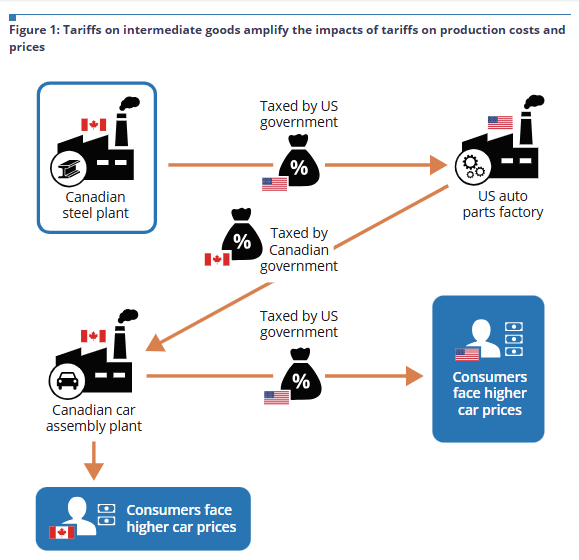

Trump’s Tariff Tussle Keeps the World Politicians and Bankers on Their Toes. Shortly after his inauguration on January 21st, Trump introduced the prospect of 25% across the board tariffs on Canada and Mexico unless these countries dedicated to do more to secure their borders. In early February, this tariff threat was delayed for 30 days to see if Canada and Mexico make progress in this regard. China on the other hand was slapped with additional 10% across the board tariffs with no clarity about what the Trump administration is hoping to see from Chinese lawmakers. Following this initial volley of tariff threats and follow-throughs, the Trump administration has proposed 25% tariffs on all steel, aluminum, autos, pharmaceuticals and semiconductors and stated that it intends to introduce a new system of reciprocal tariffs which would entail charging tariffs based on the country of origin rather than the product itself (subject to tax treaties). The goal is to reduce the US’s trade deficit outright rather than focus on “fairness” within each specific industry.

Our Take: We’ve all seen this show before, although with a little more vigor this time! For US consumers in the short-term, tariffs are often inflationary as consumers mostly continue to spend as they did before, but on now higher priced products, and only when new factories are built within the US could prices come down from post-tariff levels. That said, the additional investment in factories, transport and other capital in the US, which is typically less competitive than much of the rest of the world from a labour price point of view can make prices remain higher long-term, at least relative to the pre-tariff period. This means that if Trump is serious about a manufacturing renaissance (i.e. US onshoring), long-term inflation and interest rates in the US will likely be higher than what may have been expected pre-Trump. Outside of the US, if factories are abandoned or repurposed into less productive uses, this can be deflationary, although changes in exchange rates can often offset this deflationary effect. That said, if non-US countries introduce retaliatory tariffs to the same degree of the US’s tariffs, then the incentive to onshore production is lessened and this could result in higher prices for all consumers around the world and with no real alternative to reduce prices anywhere. If the 2018-2019 tariff period is an indication, Trump may simply be looking for small wins here and there (e.g. help in securing the border, reducing counterfeiting, reducing technology espionage, etc.) rather than create a no-win situation where America, and everyone else, becomes less great. Threats and follow-throughs of tariffs have yet to impact markets much, which is a positive change relative to the 2018-2019 period, though that may be due to growing investor comfort with more targeted tariffs over time.

Reciprocal Tariffs Are Bad For All Long-Term (Bank of Canada)

High Housing Costs Not Doing Any Favours For Canadian Economic Productivity. According to the CMHC, high housing costs are inhibiting population mobility across Canada. Household mobility has fallen to 10.1% as of 2020 compared to 17.8% in 1990 and the CMHC estimates that every 1% increase in house prices reduces migration by 1%. Canadian national house prices are up over 20% since 2020, so population mobility is expected to be far less than the 10.1% recorded in 2020.

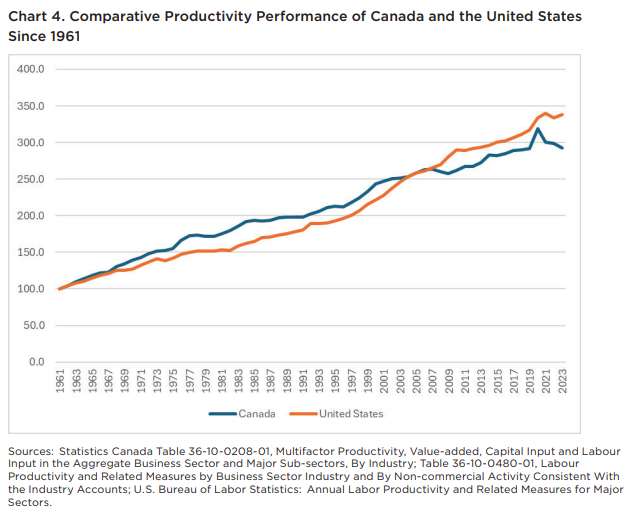

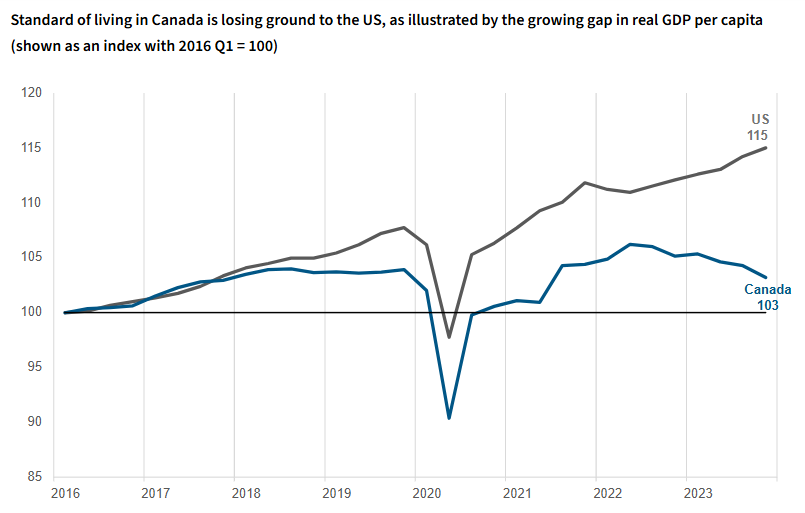

Our Take: The stagnation caused by inhibited labour mobility limits skill development, economic growth, and productivity. This ultimately increases the cost of doing business in Canada, particularly in high-cost cities where house prices are somewhat higher. This higher cost of doing business as well as the necessity of hiring potentially less productive locals makes Canadian businesses that much less competitive versus international peers, particularly those in the US. Yet another unique problem that needs solving in Canada to boost Canadian productivity and in turn Canadian economic well-being. Canada’s lower productivity also provides us less leverage in trade negotiations because we have fewer economic options to provide employers to remain in Canada.

Canada’s Productivity and Standard of Living Began to Wane When Housing Affordability Worsened Greatly Relative to the US

Just for fun

- It’s a good time to be a flag maker! According to Flags Unlimited, flag sales have doubled from a year earlier. The company attributes the boost in sales to Canada’s 60th national flag day on February 15th combined with Trump’s tariff threats as well as his threat to make Canada the 51st US state. The recent 4 Nations Cup may also be adding to the feeling of national pride. It’s been a tough winter to raise the flag but good on ya Canada!

- On the point of national pride, Canada’s national animal has been spreading Canadian goodwill all around the world. In a Czech Republic nature park, beavers completed a water restoration project in just two days, saving local authorities over US$1 million. Czech officials had been planning the project for 7 years to only have a team of beavers naturally build dams in the exact planned locations. I wonder what other human problems animals can solve for us, and for free?!?!

- Also…