Second Quarter 2024 - Show Me The MonAI

Investors Pivot From Money-Making AI Hardware to Money-Burning AI Software, Pushing U.S. Markets Higher, Leaving Other Markets Behind

It appears the excitement surrounding AI has shifted from the companies that sell AI hardware to the companies that buy AI hardware. The greatest beneficiaries of the AI boom – Nvidia and Super Micro Computer – continue to experience rapid revenue growth and are generating more cash than they could have dreamed of a few short years ago. Both companies continue to grow rapidly but stock performance has been mixed with Nvidia shares up ~37% in Q2 and down 12% from the highs (as of June 30th), while Super Micro shares were down ~19% in Q2 and are down ~33% from the highs. This mixed stock performance and material declines from their highs may highlight that momentum for AI hardware companies is waning and investors are pivoting their attention elsewhere.

It is not hard to see that investors have focused their attention on the buyers of Nvidia and Super Micro’s products, specifically Meta Platforms, Alphabet, Apple, Microsoft, Tesla, and Amazon, with these stocks seeing returns of 3%, 17%, 24%, 5%, 13% and 7% in Q2, respectively, and all seeing continued momentum so far in Q3. Throughout the quarter, virtually any announcement about AI investments or integrating AI into existing products jolted these stocks higher. The issue is that none of these companies, or other companies developing AI software, currently make much, if any money, from these AI products or AI integrations. It is unclear when and if these products will generate enough revenue to justify the billions spent. It is estimated that the AI industry (consisting largely of the six companies listed above and their associated AI startups) has spent ~$50 billion so far on Nvidia’s AI chips but the industry has only generated ~$3 billion in associated revenues. That is quite the downpayment! And this excludes all of the work hours of highly paid AI specialists required to develop, maintain and integrate any associated AI software.

The six technology companies listed above have formidable core businesses that generate plenty of cash flow, allowing them to spend nearly as much as they want on AI. Even if that spending ends up not paying off anytime soon, this spending doesn’t affect their core businesses in a negative way. The primary issue is that when stocks rise substantially due to AI excitement, but the earnings growth outlooks of those companies do not, it makes these stocks vulnerable to giving up the returns generated by the AI hype that didn’t pan out, or simply didn’t pan out as fast as many may have hoped. While it is far too early to determine if this AI spending will pay off, it hasn’t paid off yet and it doesn’t appear like it will pay off soon. This is the great risk facing these six market behemoths that now account for ~27% of the U.S. stock market.

If we look at valuations as whole, U.S. stocks as measured by the S&P 500, trade at ~28.7x trailing earnings, a level only ever seen during the 2000 tech bubble. This valuation is almost double that of the rest of the world (MSCI World Ex-US) which trades at ~15.8x and Canada (S&P/TSX Composite Index) at ~17.6x, a historic valuation gap and one that implies U.S. corporate earnings will grow at much faster rates for decades.

The good news is that the U.S. companies that are leading the charge this time are less cyclical, have less debt and carry significantly lower financial risk than in the past, making them more durable to any economic disruptions in future, which could partly justify elevated valuations. That said, throughout history large stocks that trade at well above average valuations tend to generate lower than average future returns. Stock valuations don’t tell us a lot about what will happen in the next month or year, but they do tell us about how they will perform over the long term (i.e., valuations and long-term future returns are very highly correlated).

Let the Rate Cuts Commence!

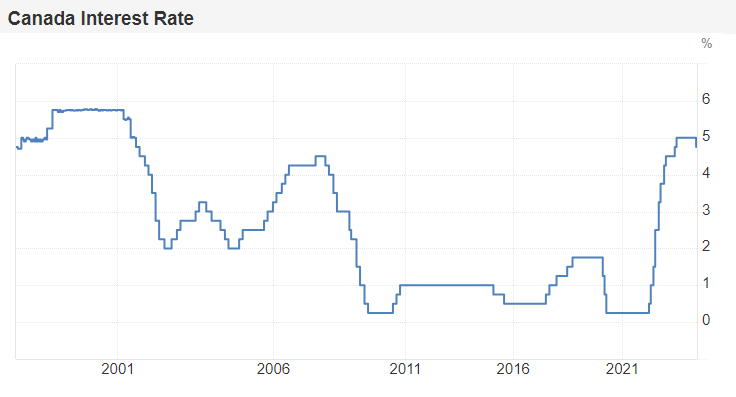

In early June, the Bank of Canada (BoC) cut its key interest rate by 0.25% to 4.75%, 11 months after its last rate hike in July 2023 and its first rate cut since March 2020. Falling inflation, which reached 2.7% year-over-year in April and now sits within the Bank’s 1%-3% target range, and rising unemployment, which reached 6.4% in April and the highest level it has been since January 2022, opened the door for the Bank of Canada to ease its restrictive policy and stimulate economic growth. The bank expects to remain cautious, and will continue to lower interest rates if inflation continues to cool throughout 2024.

The Bank of Canada’s rate cut was preceded by rate cuts in Sweden and Switzerland and was followed by a rate cut by the European Central Bank. Other central banks are expected to join in on the rate cut party in the coming months if inflation continues to cool globally.

Falling interest rates helps ease the stress currently experienced by heavily indebted households and businesses, helping boost long-term economic growth expectations. Even with the recent rate cuts, despite interest rates being in line with historical averages, financial conditions remain tight because households and businesses “got used” to interest rates of close to 0% for over a decade. For households, this meant taking on a ton of debt to buy the things people always bought (e.g., house, cars, etc.) but at higher than typical prices, and now they have to deal with the extra debt but at higher interest rates. It is expected that the Canadian economy will continue to experience weak economic growth until interest rates fall enough (~2%) to provide true relief to households and allow discretionary income to grow at a healthy pace again.

How To Position Portfolios Going Forward?

Overall market valuations continue to be elevated, largely due to very high valuations in the U.S. technology sector. Outside of large U.S. technology stocks, valuations in many other areas are reasonable when compared to history.

We have highlighted the attractiveness of interest rate sensitive stocks in the past – particularly the telecom, utilities, consumer staples, and real estate sectors. Now that the interest rate cutting cycle has officially begun, these areas of the market are looking even more attractive because they will benefit directly from lower interest rates.

We favour Canadian and international stocks over U.S. stocks, largely due to the wide valuation disparity between U.S. stocks and the rest of the world. That said, many small- and mid-cap U.S. stocks tend to trade at reasonable valuations relative to history, so there are still opportunities within the U.S. equity market.

We have limited exposure to the “AI stock darlings” but have a number of positions that should benefit from AI over time and continue to trade at pretty reasonable valuations all considered. These stocks are Alphabet (GOOG), Amazon (AMZN) and Intel (INTC) as well as broader exposures like the Invesco S&P 500 Equal-Weight Technology ETF (RSPT), which should help capture the far-reaching benefits of AI within the U.S. technology sector. Although Alphabet and Amazon were among the six technology companies that have led markets higher in recent months, we believe that they don’t need AI to “work out” for them to continue to grow at above average rates over the long term. These stocks continue to offer an attractive return expectation going forward and should be less vulnerable to an AI stock correction than the other four large U.S. technology stocks we highlighted. AI stocks are all anyone seems to be talking about these days, but it is important to stay focused on investing to meet your long-term goals, and to not chase short-term performance. Benefitting from the upside of AI stocks requires active rebalancing to capture gains as they come because as we all know, what goes up, must eventually come down.

Preferred equities continued to rally strongly in Q2. Throughout the quarter, we began to pivot from fixed reset preferred shares, which tend to perform poorly once interest rates start to decline, and started buying more perpetual preferred shares, which tend to (eventually) benefit from falling interest rates. Many fixed reset preferred shares were approaching par ($25) so capital gains upside is now limited, while the perpetual preferred shares we favour all trade well below par ($18-$20) and, therefore, offer plenty of capital gains upside in addition to dividend yields of 6.0%-6.5%.

Fixed income should begin to perform well now that interest rates are officially coming down. If we see Canadian interest rates decline by ~2% over the next two years, we can expect the Canadian bond market to return 8%-10% on average per year, subject to potential defaults, with half of the return coming from interest payments and half of the return coming from price increases as bonds adjust to falling interest rates. We will continue to maintain exposure to fixed income with prospective returns at these historically attractive levels to help increase certainty around long-term portfolio return expectations and minimize overall portfolio volatility.

Our allocation to alternative investments continues to generate consistent yields with very little volatility. Maintaining a material allocation to alternative investments continues to be a priority.

Stick to the Basics!

Maintain a diversified, income generating portfolio tailored to your risk tolerance that can weather most market environments well. Capture gains when upside potential narrows (like fixed reset preferred shares) and as momentum fades (like large U.S. technology stocks). Reinvest in areas of the market or asset classes that appear to offer outsized returns relative to risk.

You can be confident that we are constantly reviewing the risk-return of all positions and asset classes and are right-sizing your portfolio as needed.

If you ever have any questions or concerns about your portfolio or the investment markets in general, please feel free to reach out to us.

Sincerely,

The information contained in this report was obtained from sources believed to be reliable, however, we cannot present that it is accurate or complete. Information has been sourced from the RJL Bond Desk or RJ Private Client Solutions, unless otherwise noted. Index and sector returns represented in this commentary are measured using the S&P/TSX Total Return Index and S&P/TSX GICS Sector Indices as detailed in Raymond James Ltd.’s Insights & Strategies: Quarterly Edition. This report is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell securities. The views expressed are those of the author and not necessarily those of Raymond James Ltd. (Member Canadian Investor Protection Fund).

This Quarterly Market Comment has been prepared by Steele Wealth Management and expresses the opinions of the author and not necessarily those of Raymond James Ltd. (RJL). Statistics and factual data and other information are from sources RJL believes to be reliable but their accuracy cannot be guaranteed. The performance outlined in the report is net of fees. The client account performance may vary from the model portfolio due to several factors, including the timing of contributions and dates invested in model. The performance reported is that of the account that represents the model, not a composite. Performance calculation for the models may be different than the index used as a reference point. It is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. This Quarterly Market Comment is intended for distribution only in those jurisdictions where RJL and the author are registered. Securities-related products and services are offered through Raymond James Ltd.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.