HEADING INTO TAX SEASON – HERE ARE YOUR TAX TIPS!

It’s tax season again and the Canadian tax filing deadline of May 1, 2023 is fast approaching. It is essential to keep up to date with changes in the Income Tax Act to minimize your tax payable when preparing your return. For those who have a reliable and diligent accountant, feel free to zone out for the next few paragraphs. J

The Canadian system of preparing your return with the goal of calculating the least amount of tax payable, using the tax deductions and tax credits available to you, is daunting. The final tax payable calculation relies on many interrelated calculations. For example, the amount of many tax credits (basic personal amount, age amount, medical expenses, donation and gifts) and the clawback of social benefits is based on the net income. Net income is based on the amount of deductions that you choose to claim and the income splitting opportunities that are available to you. It may take many iterations of calculations to determine the best solution where you pay the least amount of tax. An understanding of the difference between a tax deduction and a tax credit is an important step in your tax preparation.

What Is a Tax Deduction?

- A tax deduction reduces your income that is subject to tax

- Therefore, the value of a tax deduction is dependent on your marginal tax rate

- Your marginal tax rate is determined by your level of taxable income

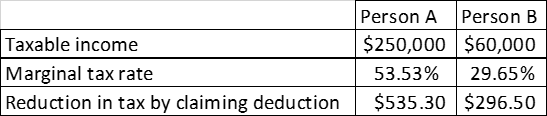

- For example, two people live in Ontario and claim a $1,000 tax deduction:

- The $1,000 tax deduction is worth about 80 per cent more for Person A with the higher income

- Tax deductions include:

- Qualifying annual union and professional dues

- Qualifying moving expenses

- Qualifying carrying charges (for example, investment management fees)

- Qualifying interest expenses (notably, interest on loans used for investing)

- Support payments (spousal and child), though conditions apply

- Employment expenses, including the temporary home office flat rate method due to COVID-19Federal COVID-19 benefit repayments

- Child care expenses, limited by age of child, both spouses must work and claim can only be made by the lower income spouse, and

- RRSP DEDUCTION

Investing in a Registered Retirement Savings Plan (RRSP) is instrumental to our client’s wealth management plans because:

- Contributions to the plan are a tax deduction, reducing tax payable (explanation below)

- The total amount of the contribution is invested but the reduction in tax lowers out-of-pocket cost

- The growth on investments inside an RRSP is tax-deferred, helping you save for the future

- Therefore, you should always contribute your maximum amount, particularly when you are younger, to take advantage of tax-deferred compounding

To understand this in more depth, check out Sam Ryder’s video - CLICK HERE.

How Do RRSP Contributions and Deductions Work?

Note that RRSP contributions and RRSP deductions may be different amounts.

RRSP Contributions

- Your RRSP contribution limit is the maximum amount that you can contribute to an RRSP

- RRSP contribution limit is set by Canada Revenue Agency (CRA)

- CRA calculates your RRSP contribution limit as:

- Your unused RRSP deduction at the end of the preceding year

- Plus 18 per cent of your earned income from the previous year

- Less pension adjustments from the previous year

- The maximum limit for 2022 is $29,210, and for 2023 is $30,780

- Unused contribution limit carries forward, so if you don’t make your maximum allowed, you can catch up in the future

- The deadline for making contributions for 2022 is March 1, 2023

RRSP Deductions

- You can choose how much of your RRSP contribution to claim as a deduction in a particular tax year

- The claim you choose may be less than the contribution you made for the year

- The amount you decide to claim may be based on:

- Your current level of income versus your future income

- How the claim will impact tax credits that are based on net income

- As shown in the chart above, an RRSP deduction results in a greater reduction of tax in a year that you are in a higher marginal tax bracket

What Is a Non-Refundable Tax Credit?

- A tax credit does not reduce your taxable income

- Instead, it reduces your federal and/or provincial tax payable

- The amount and nature of federal tax credits differ from provincial tax credits

- The level of your taxable income does not impact the reduction from tax credit

- Federal non-refundable tax credits give a tax reduction of 15 per cent

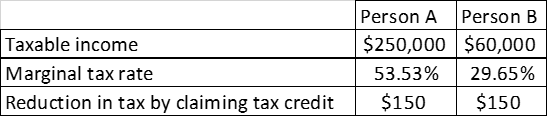

- Using the example above, two people live in Ontario and claim a $1,000 federal non-refundable tax credit:

- The $1,000 tax credit is worth the same for both people

- Common non-refundable tax credits include:

- Basic personal amount – available to all tax filers, but the value is reduced with higher income

- Spousal amount – basic personal amount unused by a low-income spouse

- Age amount – available to those over age 65 and older

- CPP (Canada Pension Plan) contributions – your annual CPP contributions are available as a non-refundable tax credit each year

- EI (Employment Insurance) premiums – your annual EI premiums paid are available as a non-refundable tax credit each year

- Pension income amount – a non-refundable tax credit, if you are receiving qualifying pension income

- Interest paid on student loans – a non-refundable tax credit equal to the interest paid on student loans

- Tuition and education amounts – a non-refundable tax credit based on education costs (some specific rules apply)

- Medical expenses – a non-refundable tax credit based on household medical expenses, including some private insurance premiums, but subject to taxable income

- Donations or political contributions – a non-refundable tax credit, if you made qualifying donations

Check Out the New Ontario Staycation Tax Credit

- A new refundable tax credit worth noting for the 2022 tax year

- A tax credit for Ontario residents

- Tax credit is 20 per cent of short-term accommodation expenses spent in 2022

- Stay must be less than a month in Ontario, at a short-term accommodation or camping accommodation (such as a hotel, motel, resort, lodge, B&B, cottage, campground or vacation rental property)

- Tax credit applies to up to $1,000 in expenses for an individual ($200 maximum tax credit value)

- For a family, $2,000 in expenses will be applicable ($400 maximum tax credit value)

- Find your receipts from your summer vacation!

How Can Steele Wealth Management Help?

Tax planning shouldn't only happen when you file your tax return. After you get your tax return for 2022 filed, spend some time to review your personal tax situation for 2023. Talk to us about tax-efficient income planning and investment strategies to minimize tax.

HAPPY TAX FILING SEASON, EVERYONE!

News and our views

- Bank of Canada Hits the Pause Button on Rate Hikes as Inflation Wanes. The Bank of Canada hiked its key interest rate by 0.25 per cent in late January and indicated that it would stop raising rates, or “pause”, after hiking rates by 4.25 per cent in less than a year. The bank highlighted that rates would need to stay high for an extended period to keep a lid on inflation. Canadian inflation, measured by the Consumer Price Index (CPI), peaked in June 2022 and has trended lower since. Because of the delayed effects of interest rate hikes on the broad economy, the Bank of Canada expects near-zero economic growth and rising unemployment for the first nine months of the year and will remain on pause if the Canadian economy maintains that course. Bond markets have priced-in interest rate cuts starting in late 2023 and that inflation returns somewhat close to the bank’s two per cent target. The Bank of Canada and many other central banks around the world have pushed back against rate cuts anytime soon, as labour markets remain resilient, posing an upside risk to inflation.

Our Take: Bond markets appear incredibly optimistic about central banks’ ability and willingness to cut interest rates. Central bankers have been clear that they fear reigniting inflation, more than anything. Many policymakers have explicitly stated that they would rather cause a deeper economic recession, in order to truly tame inflation, than be responsible for a 1970s-style period of entrenched high inflation. While a pause by the Bank of Canada is welcome, it may be dangerous to believe that it marks the end of this volatile economic period. It’s especially so when the bank is relying on a recessionary type environment to solve their inflation problem and central banks have a mixed record of engineering shallow economic slowdowns.

- Inverted Yield Curve Creates a Dilemma for Homeowners with Variable Rate Mortgages. Those with variable rate mortgages have seen their interest costs (prime rate) rise by 170 per cent since March 2022, the fastest rate of increase in history. This rapid increase in debt servicing costs has greatly affected the monthly cash flow of many households. As discussed above, bond markets expect interest rates to fall before the year is out. Looking at current mortgage rates, the best mortgage rate for a five-year insured variable rate mortgage is 5.50 per cent (which would be in line with many outstanding variable rate mortgages) while insured fixed rate mortgages range from 4.64 per cent (five year) to 5.99 per cent (one year). Those currently locked into a variable rate mortgage have the option to break their mortgage and lock in a lower fixed rate to reduce their current interest expense.

Our Take: Unless you are extremely risk averse or you need to lock in a lower rate for budget reasons, it doesn’t make sense to break your mortgage to lock in the lower mortgage rate. Breaking a mortgage comes with an upfront cost, and based on history, when the banks’ prime rate is more than 20 per cent above its five-year average, there’s a less than one-in-seven chance that locking in long-term is the right move. The only conceivable scenario where rates move much higher or stay at current levels for an extended period is if central banks are unable to contain inflation. At this point, it appears central banks are willing to do almost anything to tame the inflation dragon and keep interest rates at a reasonable level for long-term. So, riding out this period of inflated variable rates is likely appropriate for those who are facing budget stress.

Just for fun

- For the first time in 30 years, the number four ranked UConn Huskies women’s basketball team lost back-to-back games. The first loss was to the number one ranked South Carolina Gamecocks, but the second loss to the unranked Marquette Golden Eagles had to hurt. Not only did this upset generate an historic moment but also Marquette had never before beat UConn in women’s basketball.

- In what may be the biggest bet on a Stanley Cup run in decades, the Maple Leafs acquired Blues captain and Stanley Cup champion Ryan O’Reilly as well as a satisfactory bottom six player, Noel Acciari. This is clearly GM Kyle Dubas’s all-in moment, giving up four draft picks to get the deal done. O’Reilly has struggled a bit in the 2022-2023 season, dealing with a broken foot, but the hope is that he will rebound quickly on a superstar line alongside John Tavares and Mitch Marner. This bet is working out well so far, with O’Reilly notching five points in his first three games with the Maple Leafs. Fingers crossed that O’Reilly can lift the Cup again and bring it back home to Clinton, Ontario to celebrate the Leafs’ first win in 56 years!