CANADIAN DEPOSITARY RECEIPTS (CDRS): WHAT ARE THEY AND WHAT MAKES THEM USEFUL?

Periods of US dollar strength can be benefit the diversified portfolios of Canadian investors as US dollar appreciation causes US dollar denominated investments held in Canadian dollar portfolios to appreciate. This can help boost the returns of the portfolio as a whole, or help stymy losses in down markets. The opposite is also true. Periods of US dollar weakness will act as a drag on diversified portfolios as US dollar depreciation causes US dollar denominated investments held in Canadian dollar portfolios to depreciate. Nothing worse than watching the return on a US stock disappear as the US dollar slumps!

Historically, the only refuge from this US dollar depreciation was to avoid individual US stocks, leading to a potentially more concentrated (and risky) portfolio, or to buy currency-hedged US equity exchange traded funds (ETFs) that provide diversified exposure to the US. Thankfully, CIBC has recently launched Canadian Depositary Receipts (CDRs) which allow Canadian investors to attain exposure to select individual US stocks but this exposure is denominated in Canadian dollars. Effectively, investors buy a CDR on the NEO Exchange, this ownership of the CDR represents a deposit at CIBC and CIBC is contractually obligated to mimic the return of the corresponding US-listed stock, including the payment of US dividends. These CDRs are similar, but not identical to, American Depositary Receipts (ADRs), which have existed for decades and which allow global investors to access foreign stocks on US stock exchanges. The key differentiator between CDRs and ADRs is that the currency is hedged for CDRs whereas the currency is unhedged for ADRs.

The ability to attain currency-hedged exposure to individual US stocks provides significant flexibility when managing an investment portfolio. For example, if you own Alphabet shares and you wanted to capture a 10% gain in the US dollar but also wanted to maintain exposure to Alphabet shares, you can now sell the US-listed stock and buy the Canadian-listed CDR. The US dollar has appreciated over 10% from its 2021 low and is higher than most periods since August 2020. While timing currencies is notoriously difficult and there may still be some US dollar upside ahead, investors can now easily capture any currency gains as they see fit, if the appropriate CDR is available. Additionally, the existence of CDRs makes adding individual US stocks easy for those looking to add to US stocks after a period of US dollar strength. This is especially true in RRSPs and other Canadian registered accounts that hold Canadian dollars as investors no longer need to convert to US dollars to buy US stocks.

CIBC currently offers CDR versions of 35 US stocks including many widely held names such as Alphabet, Amazon, Apple, Costco, Visa, Microsoft and Wal-Mart. https://cdr.cibc.com/#/

News and our views

- Canadian Insolvencies Close to Pre-Pandemic Levels. Recent data showed that Canadian consumer insolvencies rose ~16% year-over-year while business insolvencies rose ~58% year-over-year in November 2022. Consumer insolvencies remain ~20% below pre-pandemic levels while business insolvencies are ~20% above pre-pandemic levels. Soaring inflation and higher interest rates are making life difficult for many households and businesses and the effects of higher interest rates are only starting to be felt.

Our Take: Insolvencies remain near normal levels but the trend higher appears well entrenched with plenty of financial stress ahead for consumers and businesses. Insolvencies are rising in response to higher interest rates are likely to weigh on the Canadian labour market in 2023. That said, insolvencies are likely to rise steadily, rather than sharply, and are unlikely to act as a shock to economic growth.

- European Energy Crisis Averted By A Warm Breeze. After hitting obscene levels in late summer, European natural gas prices are trading at their lowest level in 14 months as much of Europe set daily- and monthly-high temperature records reducing natural gas demand across the continent. The decline in natural gas prices has pushed inflation and inflation expectations down from multi-decade highs.

Our Take: A bit of luck goes a long way. It appears Europe will avoid a mass shutdown of European heavy industry and the fight against inflation may not be as difficult as expected in Europe and globally. This is good for the global economy as its removes one of the greatest risks to economic growth and financial stability in 2023 and is one of the first bits of truly great news in a long time.

- China’s Population Falls For the First Time Since 1961. Official Chinese government data showed that the Chinese population fell by 850,000 (0.6%) in 2022, the first decline since 1961 when the country was dealing the deadliest famine in human history. Population decline in China is driven by one of the lowest birth rates per capita in the world, net emigration and an aging population. The Chinese government has attempted to reverse the country’s rapidly falling birth rate but economic factors (e.g. high property prices relative to incomes) and social/demographic factors (e.g. population gender skew, rapid urbanization, illegality of childbearing outside marriage, falling propensity to marry amongst young Chinese due to high property prices) have prevented any true progress on this front. The downward trend in China’s birth rate is likely to continue as the population of women of childbearing age (25-35) is set to decline by 20%-30% over the next 5-10 years.

Our Take: While this is not a short-term problem by any means, declining Chinese population will further stress an already highly stressed Chinese property sector. Harvard professor Kenneth Rogoff estimates that the Chinese real estate sector accounts for ~29% of Chinese GDP, well above that of Western economies at 10%-20% of GDP. A long-term decline in the Chinese population will likely cause Chinese real estate activity to slow considerably and shrink to levels in line with global peers. Considering the great 2000s commodity super-cycle was propelled by outsized Chinese property development, an enduring slowdown in Chinese property development would logically result in a great commodity bear market. Base metals, like iron ore and copper, were the biggest beneficiaries of the commodity super-cycle and would likely be most pressured by falling Chinese property development as China consumes ~70% and ~52% of the global supply, respectively, a substantial portion of which is used in domestic construction.

Just for fun

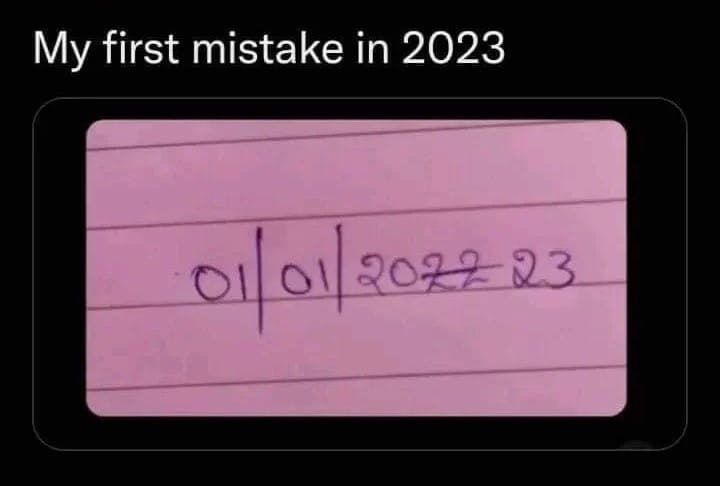

- It is a New Year and with that comes the New Year’s resolutions! Based on US studies, ~40% of adults set New Year’s resolutions. Younger people tend to make them more than other age groups, with ~60% participating. Presumably, they would have more things to resolve than older folks do. The top resolutions are health related (roughly 70%), likely because we have delayed making progress on this front and perhaps we view a New Year’s resolution as some way, any way, to get our butts moving and guilt ourselves into action. Predictably, a resolution based on the Gregorian calendar isn’t quite the motivation we need to get us past the finish line, with almost one-quarter bailing on their resolution in the first week and only ~10% keeping their resolution for good. Best of luck to everyone. We hope you are in the minority that sticks to it!

- The nerd world is rejoicing and fearing the capabilities offered by ChatGPT, a highly intuitive chatbot released by OpenAI in November 30, 2022. ChatGPT is versatile, mimicking human conversation better than nearly all other chatbots but it can also write and debug computer programs, compose music and other creative works, answer test questions and play games. While this doesn’t sound all that exciting, it may be something you need to see ChatGPT for yourself to understand the breakthrough. We gave it a try, questioning the chatbot about medical conditions and potential treatments, and lets just say that websites like WebMD may be in trouble. Further adding hype to the story, Microsoft recently announced that it would invest up to US$10 billion in OpenAI and incorporate ChatGPT features into nearly all of its products.

- Suicide is the second leading cause of death for men in Canada. This is an alarming statistic! Steele Wealth Management promotes mental wellness and suicide prevention. We invite you to watch this video where Dr. Ogrodniczuk, UBC professor and founder of HeadsUpGuys, explains reaching out for help. https://www.youtube.com/watch?v=VAUQSVIyKBc&feature=youtu.be