Solving Social In-Security

Social Security Basics and Planning Points for Recipients in Canada and Abroad

Understanding the ins and outs of the various Social Security benefits is difficult enough for financial professionals who reside in the US and work with clients who have spent their entire working lives in the US. Those financial professionals who work with clients who have spent time working in both Canada and the US must surmount an even greater wall of understanding when it comes to Social Security benefits, as well as how these benefits interact with Canadian social benefits like the Canada Pension Plan (CPP) and Old Age Security (OAS). This increased planning complexity requires a strong understanding of all these benefits and how the Canada-US tax totalization agreement comes into play.

The Steele Wealth Management team is uniquely positioned because we have the expertise and experience coordinating these Canadian and American social benefits to maximize overall lifetime benefits, maximizing annual after-tax income for our clients throughout their lifetimes.

Below we review the different types of Social Security benefits, how they interact with Canadian social benefit programs and how best to coordinate these income streams to maximize social benefits overall.

Types of Social Security Benefits

There are numerous types of Social Security benefits including:

- Retirement benefits

- Spousal benefits

- Survivor benefits, including for children of the deceased

- Divorced Spousal and Survivor benefits

- Death benefit

- Disability benefits (we will avoid exploring this benefit as it is rare for retirees and Canadian residents to encounter these benefits)

Retirement benefits. Social Security retirement benefits act to replace part of your income when you reduce your hours or stop working altogether. Social Security is essentially the American version of Canada’s CPP and OAS programs combined. The program provides consistent inflation-indexed income throughout retirement with a goal of reducing senior poverty, similar to the aims of the Canadian social benefit programs.

Social Security recipients can start Social Security retirement benefits as early as age 62 and as late as age 70. In contrast, CPP has a start date of as early as age 60 and as late as age 70 while OAS has a start date of as early as age 65 and as late as age 70. For all programs, the later you elect to receive your benefits, the more you can expect to receive. For Social Security retirement benefits, the degree of the benefit increase depends on one’s birth year/age, as per the table below.

To clarify a few acronyms:

- “FRA” stands for “full retirement age”, or one’s “normal retirement age” for their age bracket

- “PIA” stands for “primary insurance amount” or one’s Social Security entitlement at their FRA

For example, the maximum PIA for 2024 is US$3,822 per month, or US$45,864 per year so anyone who contributed the maximum amount to Social Security throughout their lifetime and who is retiring at their FRA would receive US$45,864 per year. Note that very few individuals qualify for the maximum PIA amount as most US workers have periods in which they earn income below the maximum yearly Social Security contribution thresholds.

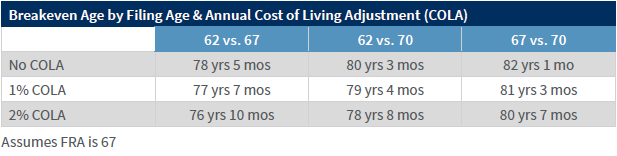

Like CPP and OAS, the breakeven age for Social Security (i.e. the age you must live until to benefit from delaying benefits) is well below the average life expectancy. The breakeven age also depends on cost-of-living (inflation) assumptions as well as one’s FRA. The table below outlines the breakeven ages for various scenarios, all showing that the breakeven age is below the life expectancy for the average 62 year old.

Minimum Credits Required to Qualify for Social Security Retirement Benefits and Totalization

To qualify for Social Security retirement benefits, you must earn at least 40 credits, which equates to roughly 10 years of employment through which you make contributions to Social Security to qualify. This effectively means 10 years of US employment, though there are some exceptions. It only takes a small amount of qualifying income to attain a Social Security credit, with the 2024 income requirement being only US$1,730 per quarter.

Under the Canada-US totalization agreement, you can use your CPP contribution years toward qualifying for Social Security benefits. As long as you have at least 6 Social Security credits, or roughly 1.5 years of contributions to Social Security, you can use your CPP contribution years to reach the 40 credit minimum requirement to qualify for Social Security benefits. This means that if you have 6 Social Security credits, you qualify for Social Security benefits if you have at least 8.5 years of CPP contributions under totalization.

Because most Social Security statements and documents state that there is a 40 credit minimum to qualify for Social Security retirement benefits, we have come across many individuals who worked in both Canada and the US who think that they do not qualify for Social Security retirement benefits. Many are not aware of totalization, how it works and how they can qualify for Social Security benefits using their CPP contribution years.

Spousal benefits. Social Security spousal benefits provide income to spouses who were financially dependent on the primary income earner or who earned substantially less than the primary income earner during their working years. The Social Security spousal benefit can be up to half of the primary income earner’s PIA, depending on the spouse’s age at retirement.

Married individuals can collect benefits on their spouse’s earnings record if:

- They were married at least 1 year or are the parent of a qualifying child,

- They are at least age 62 (i.e. the earliest age that one can start Social Security retirement benefits), and

- The other spouse has started collecting their individual retirement benefits (an important ‘if’)

Note that Canada’s social benefit programs do not have a benefit similar to Social Security spousal benefits. Also, the US definition of spouse is different than the Canadian definition of spouse. Only as recently as 2015 were same-sex marriages considered qualifying marriages for Social Security purposes and common-law marriages are not recognized in many US states.

Similar to Social Security retirement benefits, spouses can start Social Security spousal benefits as early as age 62 and their benefit goes up the longer they delay the start of their spousal benefit up to their FRA.

It is important to reiterate that:

- the primary working spouse must have started their Social Security retirement benefits before the spouse can start their Social Security spousal benefits, and

- there is no benefit to delaying spousal Social Security spousal benefits beyond one’s FRA

These two points highlight that planning around when to start Social Security retirement benefits (for a high earning spouse) and Social Security spousal benefits (for a low earning spouse) should be made simultaneously in order to maximize overall household Social Security benefits over your lifetime as a couple. We have seen cases where there is a greater than 10 year age gap between spouses and this meant that it was advantageous for the younger and higher earning spouse to start Social Security benefits as soon as possible to enable their older and lower earning spouse to start receiving spousal Social Security benefits.

It should be noted that you only receive the greater of your own Social Security retirement benefit and the Social Security spousal benefit you may be eligible to receive. Before changes made to Social Security in 2015, lower income earning spouses were able to elect to start Social Security spousal benefits early, allow their own Social Security retirement benefits to grow due to delaying the start of those benefits, and then start the larger Social Security retirement benefit at full retirement age or later. This ability to ‘double-dip’ was stopped after 2015 and individuals will only receive the greater of their own Social Security retirement benefit and their eligible Social Security spousal benefit.

To better your understanding of how Social Security spousal benefits are calculated, here is an example:

- Sanjit is eligible for a Social Security retirement benefit of US$30,000 per year at his FRA of age 67

- As the lower income earning spouse, Priya is eligible for Social Security spousal benefits of US$9,750 at age 62 or US$15,000 at age 67 (assuming age 67 is her FRA)

- These numbers represent 32.5% and 50% of Sanjit’s retirement benefit at his FRA of age 67

- If Priya qualifies for Social Security retirement benefits of ~US$18,000 at her FRA of age 67, she will receive ~US$18,000 in Social Security retirement benefits instead of the US$15,000 in spousal benefits

Many non-US spouses know little about the Social Security program and we have encountered many non-US spouses who are unaware that they would qualify for Social Security spousal benefits if they applied.

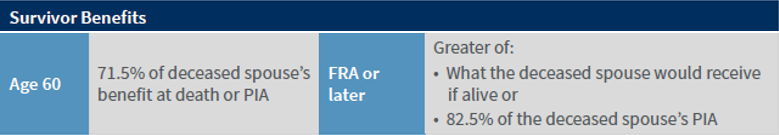

Survivor benefits. Social Security survivor benefits provide income to spouses and children of a deceased Social Security contributor.

Surviving spouses can receive the deceased spouse’s Social Security retirement benefit if:

- They were married at least 9 months or are the parent of a qualifying child, and

- They are at least age 60, unless disabled (age 50) or are caring for the deceased spouse’s child

The surviving spouse can receive up to 100% of the deceased spouse’s retirement benefit depending on the deceased spouse’s would-be age and the age of the surviving spouse, as per below. This benefit is somewhat more liberal than the CPP survivor benefit, which is typically between $5,000 and $10,000 before age 65 if the deceased spouse was a high earner and exclusively worked in Canada, and only 60% of the deceased spouse’s CPP retirement benefit after age 65, up to the maximum CPP retirement when combined with the surviving spouse’s CPP retirement benefit. In some cases, CPP survivor benefit is close to $0 after age 65.

Children of deceased Social Security contributors can receive child benefits if:

- They are under age 18

- They are under age 19 and in school, but not post-secondary, or

- They are disabled

Children can get up to 75% of the deceased parent’s retirement Social Security benefit, though there is a limit to how much the family of a deceased parent as a whole can receive. This limit varies between 150% and 180% of the deceased parent’s full retirement benefit amount. These child benefits are potentially much more substantial than what is available under the CPP program but are more difficult to qualify for (e.g. children under age 25 who are in post-secondary school can qualify for CPP child benefits).

Divorced Spousal and Survivor Benefits. An ex-spouse can receive divorced spousal or survivor benefits if:

- They were married for at least 10 years,

- They are at least age 62 for spousal benefits or at least age 60 for survivor benefits,

- For spousal benefits, the ex-spouse must be age 62 and divorced for at least 2 years (if less than 2 years, the other spouse must be receiving Social Security retirement benefits), and

- They are currently unmarried (i.e. haven’t remarried), unless they remarried after age 60 (for the sake of survivor benefits)

Death benefit. A surviving spouse or child may receive a lump-sum death benefit payment of US$255 if they live with the deceased at the time of death or if they lived apart but were already receiving benefits on the deceased’s Social Security contribution record or they became eligible for a Social Security benefit upon the deceased’s death. This payment is miniscule relative to the CPP death benefit which pays up to CAD$2,500 at the time of death and with fewer requirements to qualify. Either way, both benefits are quite immaterial in the big picture.

Windfall Elimination Provision (WEP)

The Windfall Elimination Provision (WEP) is a formula used to adjust Social Security benefits lower for people who receive “non-covered” pensions (i.e. pension benefits that accrued while NOT contributing to Social Security) such as CPP and Canadian employer pension plans.

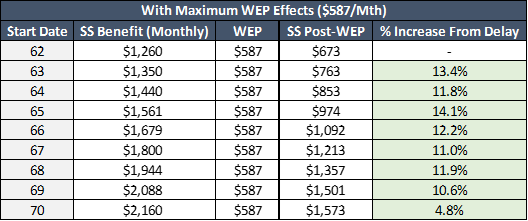

WEP can cause a reduction to your Social Security retirement benefit of up to 50% of the non-covered pension amount, up to US$587 per month or US$7,044 per year as of 2024. For example, an individual receiving CAD$15,000 (~US$11,000) in CPP benefits could see their Social Security benefit reduced by up to ~US$5,500 per year due to WEP. WEP occurs when you are receiving both a Social Security retirement benefit or disability benefit as well as a non-covered pension amount and did not rely on the Canada-US Totalization Agreement to qualify for U.S. benefits. This opens the door to pursuing strategies whereby you elect to receive only one benefit for a period of time to limit any WEP effects.

Your years of ‘substantial’ Social Security earnings are what dictate how much WEP you are subject to if you are collecting a non-covered pension. The table below shows what constitutes ‘substantial’ earnings in each year since 1937. These substantial earnings amounts are below the average wage but are not immaterial by any means so many individuals may have worked in the US but did not accrue years of ‘substantial’ Social Security earnings. The WEP reduction does not apply to individuals with at least 30 years of substantial Social Security earnings.

It should be noted that WEP does not affect spousal and survivor benefits directly BUT that spousal and survivor benefits are calculated based on the higher earning spouse’s retirement benefit AFTER WEP effects. Determining the effects of WEP and how it affects both retirement and spousal Social Security benefits is probably the most difficult and most important part of maximizing social benefits for cross-border couples.

Unique Cross-Border Strategies We Employ At Steele Wealth Management

WE BELIEVE IN SOCIAL SECURITY MAXIMIZATION THROUGH WEP MINIMIZATION!

Below are two examples that can make a big difference to a household’s after-tax income throughout retirement.

Example 1 – Taking CPP Early and Delaying Social Security Retirement Benefits

In many cases, there is limited benefit from delaying CPP. This is because half of the higher CPP benefit you receive due to delaying your CPP benefit is clawed back because of WEP.

For example, assuming someone is receiving meaningful Social Security benefits, their only non-covered pension is CPP and they have less than 20 years of substantial Social Security earnings, boosting CPP benefits from CAD$3,000 to CAD$5,000 reduces Social Security benefits by CAD$1,000. This WEP-adjusted boost to overall social benefits is far less than what the average person not subject to WEP would receive, making it uneconomical for a person with an average life expectancy. In addition, cross-border clients often have fewer than average CPP contribution years so delaying CPP benefits is further penalized relative to average due to how CPP benefits are calculated. Electing to receive CPP retirement benefits early can allow you to receive a greater percentage of the maximum CPP retirement benefit at that age and limit any additional WEP reduction to your Social Security benefits.

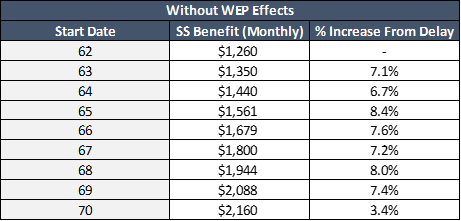

To show why taking Social Security later can be beneficial when one is affected by WEP, the tables below show the percentage increase to Social Security retirement benefits for someone without WEP effects versus someone with WEP effects. Delaying Social Security retirement benefits for someone subject to maximum WEP effects is more advantageous than someone unaffected by WEP as these benefits grow from a WEP reduced base. Focus on the right column in the tables below.

Taking CPP early and Social Security late can result in much greater combined benefits over your lifetime, assuming average life expectancy. Everyone’s situation is unique and whether you have a spouse who is also receiving CPP benefits can impact the potential value provided by taking CPP retirement benefits early and Social Security benefits late. Reviewing your situation with the Steele Wealth Management cross-border experts before making any CPP or Social Security decisions is a must.

Example 2 – Commuting Canadian Employer Pension To Avoid WEP

Many individuals who contribute to CPP and to an employer pension could see their Social Security retirement benefit reduced by maximum WEP (US$7,044 in 2024) when they start to receive these benefits.

Commuting a Canadian employer pension (i.e. taking the lump-sum commuted value of the pension benefit and transferring the majority of this amount to a locked-in retirement account [LIRA]) can avoid WEP as withdrawals from a LIRA are not included in the WEP calculation.

In some cases, when WEP incorporates the Canadian employer pension benefit, the inflation-adjusted rate of the return on the pension benefit can be close to 0%, as opposed to the typical inflation-adjusted rate of return of 2%-4% for those unaffected by WEP. While this is rare, we have seen situations where this is the case. Not everyone can transfer the full commuted value of the pension benefit to a LIRA so the terms related to pension commuting need to be examined closely before any decisions are made.

Avoiding WEP also effectively avoids WEP for your spouse, if they are eligible for Social Security spousal benefits, as their spousal benefits are based on the higher income earner’s Social Security retirement benefit after WEP. In this case, the impact of commuting the Canadian employer pension to avoid WEP could be material.

In all of the examples below, we assume that the individual can achieve an annual pension/income of CAD$30,000 from the pension’s commuted value. We see this as a reasonable expectation given that most pension plans calculate the commuted value using a 2%-4% inflation-adjusted rate of return which is well below the long-term return experience for investors with balanced portfolios.

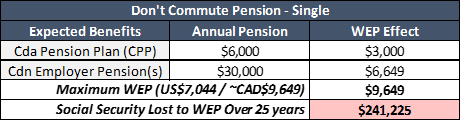

To show how remarkably powerful commuting a Canadian employer pension to avoid WEP can be, below is an example of a single person who expects to receive CPP, Social Security, and Canadian employer pension benefits, and who is subject to full WEP. Over 25 years, this person can expect to miss out on ~CAD$241,225 in Social Security retirement benefits due to WEP.

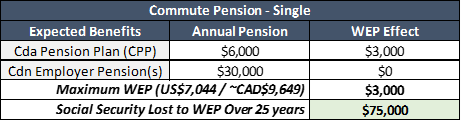

Now take that same person, who instead commutes their Canadian employer pension, avoiding ~US$4,853 (~CAD$6,649) in WEP each year. Over 25 years, this person can expect to forego ~CAD$75,000 in Social Security retirement benefits to WEP, CAD$166,225 less than if she elected to receive a Canadian employer pension. Further, this extra CAD$166,225 in Social Security retirement benefits received will likely be much greater if invested over this 25 year period.

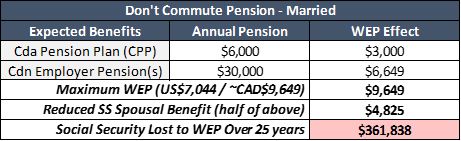

To emphasize the point let’s see what happens when we introduce a spouse who is eligible to receive spousal Social Security benefits based on the higher income earner’s Social Security earnings record. Below is an example of the married version of the single person who expects to receive CPP, Social Security, and Canadian employer pension benefits, and who is subject to full WEP. Over 25 years, this person, and their spouse, can expect to miss out on ~CAD$361,838 in Social Security retirement and spousal benefits due to WEP.

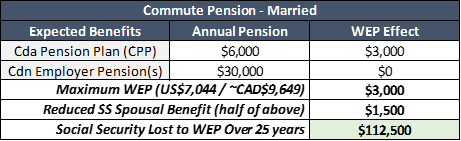

Now take that same married person, who instead commutes their Canadian employer pension, avoiding ~US$8,376 (~CAD$11,474) in direct (retirement) and indirect (spousal) WEP each year. Over 25 years, this person and their spouse can expect to forego ~CAD$112,500 in Social Security retirement and spousal benefits due to WEP, CAD$249,338 less than if she elected to receive a Canadian employer pension. Further, like the single person example above, this extra CAD$249,338 in Social Security retirement and spousal benefits received will likely be much greater if invested over this 25 year period.

Commuting your Canadian employer pension to avoid WEP can be incredibly advantageous over one’s lifetime. Not all individuals would benefit in the same way and not all pension plans are the same so it is important to review your specific situation with Steele Wealth Management before taking any actions regarding your pension.

CONCLUSION

Coordinating US and Canadian government benefits, and employer pensions, to maximize overall annual after-tax income in retirement requires a deep knowledge of social benefit programs, how they impact each other and how totalization agreements affect these benefits. We at Steele Wealth Management have deep knowledge in this area and have over a decade of experience coordinating government benefits and employer pensions to put more money in the pockets of our clients.

If you are a cross-border person approaching an age when these decisions are made (age 50 to 70), reach out to us to see if we can be of assistance. If you know of a cross-border person approaching an age when these decisions are made, let them know there are professionals with this type of expertise. We are here to help!