MIND YOUR RMDS

As we near the end of another calendar year, it is important to be aware of the requirement to withdraw minimum distributions from individual retirement accounts. Care must be taken to ensure compliance with the rules – especially as some of those rules have shifted in the past year.

The Steele Wealth Management team understands and integrates the complicated RMD rules into financial plans for our cross-border clients. We help keep our cross-border clients compliant with the regulations in both Canada and the United States. This edition of Wealth Without Borders is a summary of the RMD requirements.

WHAT IS A REQUIRED MINIMUM DISTRIBUTION

A required minimum distribution (RMD) is the minimum annual amount that must be withdrawn from an individual retirement account (IRA) to avoid penalty. The rules for the requirement to annually withdraw the correct amount from an IRA as the original owner or as a beneficiary of an inherited IRA are specifically regulated by the IRS.

Generally, an RMD for an IRA is calculated for each account by dividing the prior December 31st value by a life expectancy factor based on the owner’s situation. The life expectancy tables used are published by the IRS.

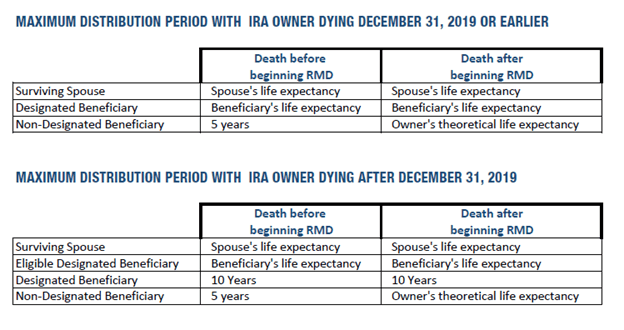

An RMD for an inherited IRA will depend on the date of death of the owner, the classification of the beneficiary and the withdrawal option chosen by the beneficiary.

RMD requirements for individual retirement account owners

Owners of IRAs that reach a certain age:

- 70 1/2 for those born before July 1, 1949; and

- 72 for those born after

are required to take RMDs from their IRAs. The first RMD can be delayed until April 1 of the year after age 72 is reached. However, if the RMD is delayed, the second RMD must be taken in the same tax year. This may inflate taxable income for that year pushing income into a higher tax bracket. Therefore, it is usually more tax efficient to take the RMD by December 31 of the year in which the owner turns 72 and spread the income over two tax years. Subsequent RMDs must be taken no later than December 31 of each calendar year.

When determining the amount to withdraw from an IRA, be mindful of how taking a distribution will impact taxable income and the resulting tax bracket. If there is space left in the tax bracket or it is a lower taxable income year, taking additional distributions should be considered.

RMD REQUIREMENTS IN YEAR OF DEATH

If the IRA owner died in the year and had not yet withdrawn the RMD, the IRS requires that it be taken before the end of the year.

RMD requirements for inherited individual retirement accounts

RMD REQUIREMENTS FOR designated BENEFICIARIES

Beneficiaries are considered designated if they are named on the IRA by the deceased owner and are natural persons (that is humans with a life expectancy). The rules for the RMD requirements differ depending on the year that the owner died and whether the beneficiary is considered an “eligible designated beneficiary.”

Designated beneficiaries who can use the Stretch Rules

Designated beneficiaries who inherited an IRA before 2020 are able to use the stretch rules to calculate the annual RMD.

As well, those who are classified as “eligible designated beneficiaries” are also able to use the stretch rules for the RMD calculation. There are five classes of eligible designated beneficiaries:

- Surviving spouses of the deceased IRA owner

- Individuals who are older than, or not more than 10 years younger than, the deceased IRA owner

- Minor children (but not grandchildren) of the deceased IRA owner, until they reach the age of majority

- Disabled individuals (defined by IRS rules)

- Chronically ill individuals (defined by IRS rules)

The stretch rules allow the beneficiary to take RMDs based on their own life expectancy, according to the IRS life expectancy tables. This allows younger beneficiaries to have a reduced annual RMD and the time required to withdraw the IRA funds is stretched over the longer life expectancy. This leaves more investments to grow tax-free for a longer period of time.

Designated beneficiaries who must use the 10 Year Rule

The Setting Every Community Up for Retirement Enhancement Act of 2019, better known as the SECURE Act, eliminated the use of the stretch rules for beneficiaries who inherited an IRA after 2019, except for those who meet the eligible designated Beneficiary classification (see above). To read more about the SECURE Act refer to our Wealth Without Borders discussion on the topic.

The SECURE Act specified that designated beneficiaries who inherit an IRA after 2019 must withdraw the investments using the 10-year rule. The mandatory 10-year rule stipulates that all funds from an inherited IRA must be fully withdrawn within 10 years of the death of the original IRA owner.

Initially the rule was interpreted as not requiring annual RMDs and the investments could remain invested in the IRA without a specified withdrawal amount for 10 years. However, the IRS proposed regulations in February 2022 state that there are annual RMDs in years one through nine with a mandatory withdrawal of the balance of the investments in the tenth year after death.

This caught many IRA beneficiaries off-guard with missed distributions between the time that the SECURE Act became law in 2020 and the IRS clarification in 2022. These overlooked distributions would be subject to a punitive penalty of 50% of the amount missed. Fortunately, in October 2022 the IRS provided relief and waived the penalty for those beneficiaries who did not take withdrawals in 2021 or 2022.

The proposed regulations have yet to be finalized and therefore there is still some uncertainty regarding inherited IRAs and the 10-year rule. However, the relief provisions do alleviate the fear of the substantial 50% penalties for not taking distributions prior to 2023, and give another calendar year to make RMDs on these inherited IRA plans.

RMD REQUIREMENTS FOR non-designated BENEFICIARIES

The class of non-designated beneficiaries includes:

- Beneficiaries who are not named (designated) on the beneficiary form and likely inherited the IRA through an estate

- Beneficiaries who are not individuals (for example estates and charities)

For non-designated beneficiaries, RMDs are based on whether the IRA owner dies before or after the owner’s required RMD beginning date. The SECURE Act did not change the RMD rules for non-designated beneficiaries.

If the IRA owner dies before RMDs are required, the account must be distributed to the non-designated beneficiary using the 5-year rule. The mandatory 5-year rule stipulates that all investments from the inherited IRA must be fully withdrawn by the end of the fifth year after death. There are no annual RMDs during the 5-year window.

Note that if the non-designated beneficiary inherited the IRA in 2016 and RMD calculations fall under the 5-year rule, then the remaining balance must be withdrawn by the end of 2022. This actually is 6 years after the year of death because the requirement for withdrawals in 2020 was waived due to the pandemic.

If the IRA owner dies after the beginning date for required distributions, there are annual RMDs for the non-designated beneficiary. RMDs may be calculated using the deceased’s theoretical remaining life expectancy as if they continued to live. This is commonly referred to as the ghost life expectancy rule and may produce a post death payout that exceeds 10 years.

Summary of inherited IRA distribution time periods

Penalties for missed rmdS

There is an onerous 50% punitive penalty tax on amounts not withdrawn to meet the RMD rules. Be sure to speak with us to ensure you’ve met your obligations to avoid any penalties.

CONTACT US FOR HELP

At Steele Wealth Management, we understand the challenges involved in managing wealth in both countries and our experience with complicated situations provides us with the expertise to help. The requirement to annually withdraw the correct amount from Individual Retirement Arrangements as the original owner or as a beneficiary is just another example of the complications that we help our clients address. We offer a consolidated wealth management solution, coordinate entire portfolios of assets to keep our clients compliant with their obligations in both Canada and the US and on track to achieving their vision and financial goals.

For more information check out Cross-Border Services on our website.