Bare Trusts and New CRA Tax Reporting Rules

Prior to 2023, trusts were only required to file a trust income tax and information return (T3) if the trust had income tax payable or it distributed some or all of its income or capital to beneficiaries. For 2023 and subsequent years, “express trusts” will also have to file a trust return.

An express trust is generally a trust created by the free and deliberate act of the parties involved, usually based on written documentation, but this is not required. Express trusts are generally considered to be an arrangement under which the trustee can take no action without the instructions from that beneficiary, the trustee’s only function is to hold legal title to the property, and the trustee can reasonably to be considered to act as an agent for a beneficiary when the trustee has no significant powers or responsibilities.

Examples of express trusts include:

- In trust bank accounts for minors or anyone else,

- In trust investment accounts for minors or anyone else,

- Parents on title for houses owned by children, and

- Bare trust arrangements where legal ownership is being held on behalf of another person.

Trusts exempt from the new reporting rules include:

- Mutual fund trusts, segregated funds and master trusts,

- Trusts governed by registered plans,

- Lawyer’s general trust accounts,

- Graduated rate estates,

- Qualified disability trusts,

- Trusts that qualify as non – profit organizations or charities,

- Trusts in existence for less than 3 months in the reporting year,

- Trusts that hold less than $50,000 in assets throughout the taxation year provided that their holdings are confined to deposits, government debt obligations and listed securities.

The person who has the legal ownership, but not beneficial ownership, is required to file the T3 return. Prior to filing a T3 return, you need to first apply for a trust number with CRA using the T3APP form either online or by mail. Schedule 15 of the new T3 return requires names, addresses, Social Insurance Numbers (SINs) for the settlor, trustees, and all beneficiaries. The filing deadline for trust returns is 90 days after December 31 of the prior year, so time is running out to file for the 2023 tax year. That said, there are no late filing penalties for 2023 bare trust T3 returns for those filing late under circumstances that do not amount to gross negligence.

In future years, there are late filing penalties for those who do not file in time, including:

- If there is a balance owing to the Canada Revenue Agency (CRA), the late filing penalty is 5% of the unpaid tax plus 1% per full or partial month up to 12 months,

- If there is no balance due, the late filing penalty is $25 per day that the T3 return is late up to a max of $2,500,

- If the failure to file is made knowingly or under circumstances amounting to gross negligence, the late filing penalty is greater of $2,500 and 5% of the maximum fair market value of the assets held during the tax year of the trust.

If you think you may have legal ownership of a bare trust and may be required to file a T3 return, we are happy to review this with you.

News and our views

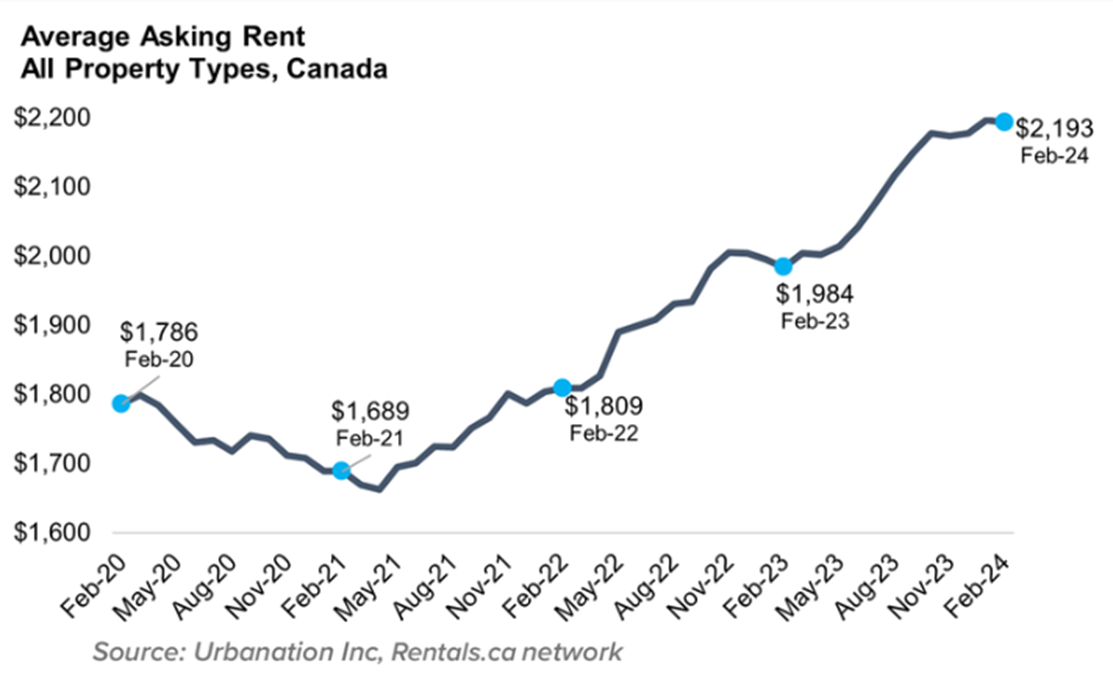

Canadian Rental Price Growth Keeping Inflation Elevated. According to a report by Rentals.ca and Urbanation, the average asking price for a rental unit in Canada rose 10.5% year-over-year in February 2024. High rental price growth supports higher house/property prices, boosting inflation for new homebuyers as well. While average rental growth is elevated, the province-by-province picture varies with more affordable Albertan properties seeing rental price growth of 20.0% year-over-year and pricier B.C. and Ontarian properties seeing rental price growth of 1.3% and 1.0% year-over-year, respectively. In major cities like Vancouver and Toronto where prices are higher than average, rental prices changed +0.5% and -0.2% year-over-year, respectively. This data shows that there is a limit to how much renters are willing and able to pay relative to incomes.

Our Take: Heading into 2024, bond markets expected that the Bank of Canada, and central banks around the world, would tame inflation in early 2024 and begin to cut interest rates between March and June. Strong rental growth will act to keep overall Canadian inflation elevated and may prevent the Bank of Canada from lowering interest rates for quite some time, and bond markets have adjusted to this new reality. That said, as the province-by-province disparity in rental price growth shows, higher interest rates are working to reduce rental demand and inflation in the highest priced markets, and Alberta and other lower priced markets will likely see rental price growth trend lower with time. The path to lower inflation appears to be in place, despite minor bumps along the way.

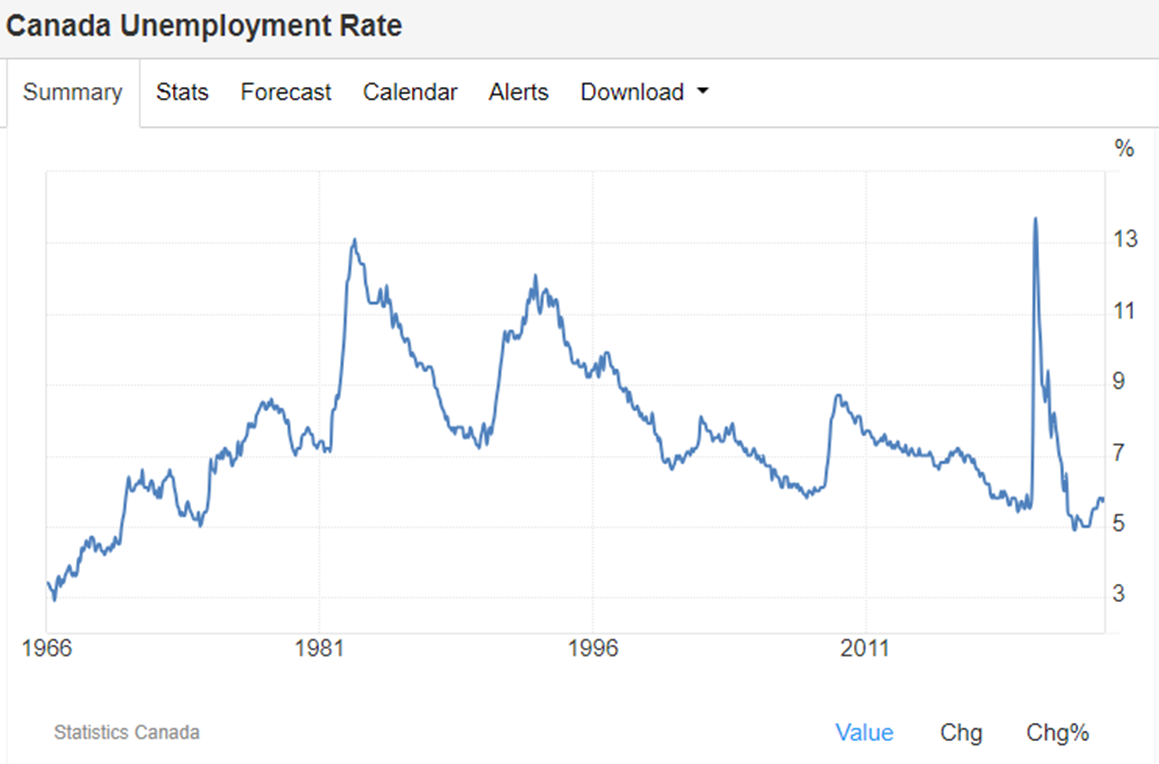

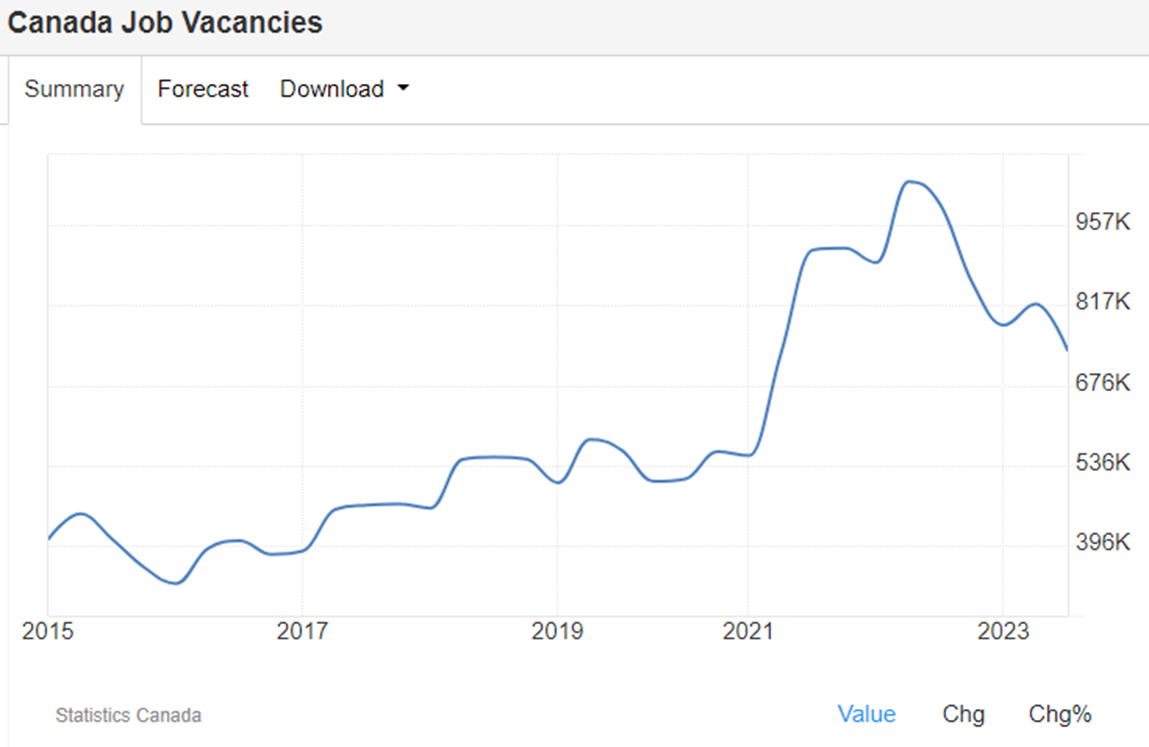

Canadian (and US) Labour Markets Are Still Beating Expectations. Another reason why rental prices are rising is the fact that the labour market has shown few signs of slowing down, despite higher interest rates and low economic growth. The Canadian unemployment rate has risen from the post-pandemic lows but remain near 50-year lows. Labour markets were expected to be resilient following the pandemic due to much greater than normal job vacancies and an excess of job vacancies remains, at least as of Q3 2023, the most recent data available.

Our Take: Once the unemployment rate starts rising, it tends to keep rising until we enter a recession and new economic cycle begins thereafter, as seen in the chart below. If central banks are adamant on taming inflation, they will likely need to see labour markets weaken further before claiming that all is mission accomplished with respect to inflation. While this time could be different, especially given the abnormal glut in job vacancies, it nudges one to be cautious about being too optimistic about economic growth over the next year or two as a weak labour market and strong economic growth rarely go hand-in-hand.

Just for fun

- The Madness Returns! March Madness kicked off March 19th and ends April 8th. Whether you’re a basketball fan or not, it is hard to find games or a tournament with more heart than what you see in March Madness. If you’re a betting person, there’s nothing better than betting on teams you know nothing about and have no vested interest in. If you bet on the Maple Leafs and they lose, you lose money and a part of yourself, but if you bet on Villanova and they lose, well where’s Villanova anyway?! The favourites heading into the tournament are the UConn Huskies, followed closely by the Houston Cougars and the Purdue Boilermakers, but forget about those because everyone loves an upset anyway. To get you hyped up, give a click here.

- 102.1 The Edge, or CFNY for our Boomer readers, recently launched a program titled Spirit of Radio Sundays from 11am to 5pm featuring artists that defined the alt rock format including U2, Depeche Mode, New Order, The Smiths, Tears for Fears and others. Alan Cross, long time CFNY DJ, and others have been working on a documentary capturing the Spirit of Radio years (1977-1992) at CFNY, which is expected to be complete by the end of March. We at Steele Wealth Management embrace the Spirit of Radio and salute those who Just Can’t Get Enough and go Head Over Heels when appropriate :P For the truly hip, we invite you to read an article about the meaning behind Rush’s song Spirit of Radio, inspired by CFNY, its eclectic mix of music and its focus on the music, not the money.