INVESTING FOR MEANING: WOULD YOU LEAVE A LAMBORGHINI IN THE GARAGE?

Step one on the road to financial success is investing your dollars in assets that generate more dollars, ideally in a steady and predictable way. This is something we help you achieve, but this is only step one. To stop at this stage is like owning a Lamborghini and never taking it out of the garage. Where is the fun and what is the point of owning it, no offense collectors, if you don’t take it for a spin at some point?

An equally important step two is what you do with those dollars to create meaning. Few people will look back on their lives and think, “Boy, those dividends I received from those stocks over all of those years are what I remember and cherish”. It is what you do with the dollars that matters (i.e. the ‘driving the Lamborghini’). Not everyone is a Lambo-buff so everyone’s ‘Lambo’ will be different. Maybe your thing is making memories through travel, or helping and spending time with people important to you, or supporting causes close to your heart or maybe all of these or something else. Some things must be done while you are living while other things can be done after you are gone (e.g. inheritances). It is important to remember that you do not have to wait for step one (building your fortune) to be fully complete to embrace step two (taking a drive around the block!).

Investing in Meaning Requires a Deliberate Gearshift

For some, it is hard not to become trapped in a loop of saving and investing. After years of working and accumulating, that pattern and mindset can make it challenging to shift to step two. Indeed step one often takes place during a hectic and jam-packed time of life and there often isn’t head space for deeply contemplating the ‘meaning’ part. Over and over, we see folks who are so very good at step one that they stay there. It’s comfy there. It takes a deliberate effort to plan for and implement step two.

Compounding Returns = Compounding Meaning, But Only If You Prioritize It

Interestingly, the beneficial effects of compounding investment returns over time can also apply to the meaning derived from allocating investing returns. For example, if you spend money on travel together, you initiate a compounding effect on the memories shared with your travel companions. Similarly, if you spend on causes important to you, there can be a compounding good over time, not only the on-going joy you experience but also the long-term positive effects on your chosen cause.

We highly encourage you to reflect on and establish the purpose of money in your life.

Money is merely the key that turns the engine over to meaning, whatever that is for you. Discussing your goals for your money and your goals for your life is core to what we do with you as financial advisors. Sometimes it is our duty to remind you to jump into the driver’s seat and do some donuts!

Economic Tidbits central banks poised to rapidly increase interest rates despite economic stress

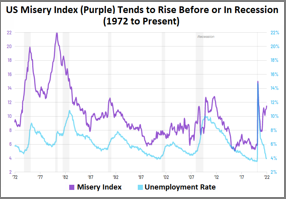

- After dragging their feet, possibly for too long, the US Federal Reserve and other central banks look poised to raise interest rates aggressively in 2022, despite growing economic stress and rising odds of a global recession. Opting for much higher interest rates shortly after the recent spike in energy and shelter costs is a bold strategy and one that is sure to put stress on households and corporations.

Le JIT A “Just-in-TIME” rundown oF our current investment theme

Stay-at-Home Stocks Appear To Have Followed the Path of Tech Stocks in 2000; Opportunity Awaits?

- The similarities shared by the dot-com bubble and the COVID “stay-at-home” bubble are too many to ignore. If the dot-com bubble is the best template for examining the post-COVID period, then it may also provide a template about how to invest now that high growth technology stocks have crashed.

- Stocks that survived and thrived following the popping of the dot-com bubble – Cisco, Amazon, eBay, Qualcomm and Microsoft – fell 65%-95% from the bubble highs to lows, erasing their 1998-2000 gains. These stocks fell this much peak-to-trough despite continuing to grow at impressive rates throughout the downturn. The downturn proved to be a valuation reset, and as we know, all of these stocks are well above the dot-com lows, having fulfilled much of the hype that investors harboured in the late 90s.

- It is worth noting that dot-com stocks bottomed before broad equity markets bottomed. Of the five stocks mentioned above, two bottomed in 2000, one bottomed in 2001 and two bottomed in 2002, despite the S&P 500 and NASDAQ 100 both bottoming in 2002 and remaining depressed until early 2003, just as the global economy accelerated out of recession.

- Therefore, it is not a stretch to believe that stay-at-home bubble stocks, that have strong competitive advantages, if not monopolistic market positions, and have fallen similar percentages from their post-COVID peaks, may be good long-term buys at current prices. Many stay-at-home bubble stocks are still forecasting double-digit growth ahead, similar to their dot-com peers during the 2000-2002 period.

- In our view, stocks that meet these monopolistic high growth criteria are DocuSign (DOCU), Zillow (Z), Zoom Video Communications (ZM), Illumina (ILMN) and Uber (UBER). These stocks have fallen as much as 42%-83% from their highs (erasing their pandemic incited gains) but all appear capable of extracting significant value from their monopolistic positions going forward. The key to picking stocks out of the rubble is to avoid modern day versions of Pets.com. The stocks above generate billions in revenues and are profitable, close to being profitable, or intentionally not profitable (due to capital investments).

Key risk points: These stocks are more volatile, are perceived to be more risky than average and tend to decline alongside equity markets. All of these stocks derive the majority of revenues from the US.

Jeannine’s Tip o’ the month Key personal tax changes in the 2022 Canadian Federal Budget

In early April, the Canadian federal government released its 2022 budget. Over the past two years, the average Canadian house price rose over 50%. In response to this decline in housing affordability, the budget proposes a number of measures to cool the housing market and improve affordability. Detailed information on the Tax-Free First Home Savings Account (TFFHSA), the Multigenerational Home Renovation Tax Credit, the doubling of the Home Buyer’s and Home Accessibility Tax Credits and residential property flipping rule can be seen here.