SNOWBIRDS BEWARE! CANADIANS SHOULD TRACK TIME IN THE US TO AVOID THE IRS

If you are a frequent visitor to the US or stay for a few months a year, it is important to track your time south of the border. If you spend too much time in the US, you could be considered a US resident for immigration or tax purposes and be subject to travel bans and/or US tax filing obligations.

US Immigration Residency Rules – Pretty Simple

US immigration rules are simple but there is an important distinction. If you are a Canadian resident, you cannot spend more than 182 days in the US per year, on a 365-day rolling year basis. While we are used to thinking of years as calendar/tax years, this rolling year distinction is something to note. If you end up going over this 182-day limit, you could be considered an illegal resident of the US and be banned from the country for up to 10 years. You also risk losing your Canadian residency and the universal health care coverage that comes with it.

US Tax Residency Rules – Not So Simple

US tax rules are more complicated. US tax residency is based on your time spent in the US over a three-year period, as measured by the Substantial Presence Test (SPT).

Number of days spent in the US in the current calendar year

+

1/3 of the days spent in the US in the previous year

+

1/6 of the days spent in the US in the year before that

If the total of the formula above exceeds 182 days, you would be considered a US resident for tax purposes and subject to US tax filing obligations. A ‘day of presence’ is any day you are physically present in the US, excluding US territories and US airspace. There are exceptions for commuters who live in Canada or Mexico or those travel through the US for less than 24 hours, crewmembers of foreign vessels, those unable to leave the US because of a medical condition developed in the US as well as some individuals temporarily in the US under on special visas (students, teachers, etc.).

If you are over 182 days as per the SPT, the US government may allow you to spend up to 182 days in the US per year, without being considered a US tax resident, if you qualify for the Closer Connection Exemption. To qualify for this exemption, you must annually file Form 8840 with the IRS each year, attesting that most of your property and family resides in Canada and most of your day-to-day life is conducted in Canada. Similarly, though less ideally, you may be able to avoid US taxation by filing a non-resident alien return as well as a treaty exemption statement with the IRS. The US Customs and Border Protection website can help you track travel history and compliance.

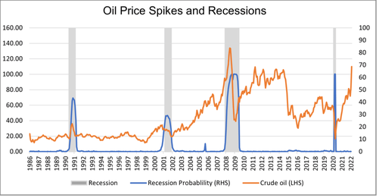

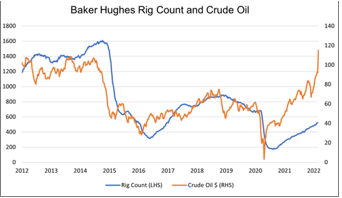

Economic Tidbits russian sanctions threaten economic recovery & Drill, baby, drill or recession?

- In response to the Russian invasion of Ukraine, Western nations introduced aggressive sanctions and import bans against Russia, with the US even banning the import of Russian energy. Russia banned the export of fertilizers in retaliation. While many deem these actions as necessary, they are likely to push theprice of core economic inputs higher, threatening the Global economic recovery.

- The longer the Russia-Ukraine conflict lasts, the greater the effect on energy importing countries. Gasoline prices have skyrocketed globally, reducing household discretionary income. “Drill, baby, drill” is long gone but boosting North American energy production (blue line = US drilling rig count) could lower energy prices and boost household income, softening a potential recession in North America.

Le JIT A “Just-in-TIME” rundown oF our current investment theme

Gold and Gold Miners Are the Only True Flight to Safety Securities Amidst Russia-Ukraine Turmoil

- Expectations of rapidly rising interest rates appear to have prevented investors from piling into US Treasuries and the US dollar throughout the Russia-Ukraine conflict so far. Interest rate expectations are being pulled in two directions. On one hand, high oil, food and some base metal prices increase inflation expectations and therefore interest rate expectations, but on the other hand, high input costs are likely to reduce global economic activity, which lowers interest rate expectations. At the current time, it appears that gold and gold miners are the only “safe” asset rallying in response to the conflict.

- Barrick Gold (ABX) and Agnico Eagle (AEM) are two ideas related to this theme.

- Barrick and Agnico trade at ~1.5x and ~2.0x price to book value, roughly in line with their historical valuations. In times where gold and gold miners are in favour, particularly an investor flight to safety or periods of high inflation, gold miners can trade at 3x book value or higher. Given the elevated odds of 1970s style inflation, as a result of the war induced supply shock, buying blue chip gold miners near their historical average valuation appears to be a reasonable bet and good hedge within a diversified portfolio.

Key risk points: Gold mining stocks can be defensive in times of high inflation or market/economic turmoil but are still susceptible to equity market sentiment and liquidity crises. If the Russia-Ukraine conflict ends in the near-term, gold mining stocks would likely come under pressure.

Jeannine’s Tip o’ the month Email encryption is required for emails containing Client PII

Steele Wealth Management now uses email encryption extensively when communicating with clients. Any emails containing personally identifiable information (PII) will be encrypted to protect your information and identity. PII includes any information that allows someone to infer your identity so the definition of PII is broad.

In order to access the encrypted emails we send, you will need to create a profile with Proofpoint Encryption. You will be prompted to create a profile, or log into your profile, when you receive an encrypted email from us. Once you have created a profile, please be sure to keep the password handy. If you have any questions, please reach out to us!