FINANCIAL ADVISOR SUCCESSION A STRONG TEAM PROVIDES YOU WITH CONTINUITY

Finding the right financial advisor can be tough. As trust is the most important factor in the decision, we often choose someone that we know and trust or someone referred to us by someone we know and trust. Credentials, fiduciary status and independence to act strictly in the client’s best interest all matter but the level of trust you have in your advisor is paramount.

While we trust our advisor to do what is in our best interest, the stark reality is that our advisor will not be around forever. Another reality is that the majority of investors have an advisor who is roughly the same age as them. Your financial advisor retiring around the same time as your own retirement is not only an inconvenience but starting over with a new advisor around this critical life transition also poses a risk to the continuity of your entire financial plan and could result in you missing some important financial planning opportunities.

This common problem leaves many investors open to the strength of the succession planning acumen of their advisor. One of the key obligations of a financial advisor is to ensure that their clients are on track to meet their financial goals over time. This makes an advisor’s succession plan, and ensuring continuity of his or her client’s financial plans, essential to his or her client’s success as investors.

At Steele Wealth Management, we recognize that our responsibility to our clients goes beyond investment management and providing advice that helps keep you on track to meet your financial goals. It is our responsibility to accompany you on your financial journey and ensure you get there. If we are blessed enough to manage the affairs of your children or grandchildren, you can be confident that Steele Wealth Management will be accompanying them along the way as well.

Steele Wealth Management has built a multi-generational financial advisory team that ensures team members familiar with your financial situation are always accompanying you on your journey. In the event your primary advisor suffers retirement, incapacity or death, there are team members available to help ensure your accounts are well taken care of and that you remain on track to achieve your goals.

We believe a large team consisting of individuals with their own areas of expertise not only helps provide you with the best possible financial advice but also provides you with consistency of service when expected, or unexpected, things happen.

Don’t simply trust that we will be there to see you through on your financial journey, meet the multi-generational team of experts we have assembled with you in mind!

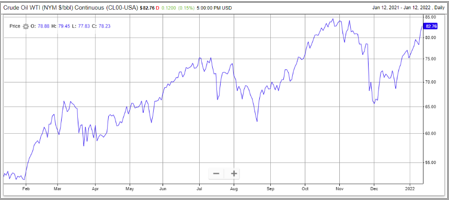

Economic Tidbits oil prices whipsawed by OPEC policy and civil unrest in central asia

- Oil prices have been volatile over the past 1-2 months. Prices initially fell from seven-year highs as OPEC+ affirmed that it would increase its oil supply despite the economic disruptions caused by the Omicron variant. Prices have since rallied back to seven-year highs as civil unrest in Kazakhstan, the world’s 18th largest oil producer, stoked fears of a sustained cut in global oil production.

Le JIT A “Just-in-TIME” rundown oF our current investment theme

COVID-Era Favourites Fall From Grace As Growth Rates Slump But Valuations Are More Palatable

- DocuSign (DOCU) and Zoom Video Communications (ZM) are two ideas related to this theme.

- The COVID-19 pandemic and related lockdowns and capacity restrictions forced many businesses to digitize their processes in short order to survive. With the pandemic lasting longer than many initially predicted, demand for digital business solutions has remained higher for longer. Consumers also widely adopted digital solutions to communicate with friends and family. While demand growth for digital business solutions is likely to wane when employees return to the office, the corporate relationships established during the pandemic are likely to remain in force.

- DocuSign is the leader in cloud-based electronic signature solutions with an estimated 70% global market share. The e-signature market was growing rapidly before COVID as e-signatures reduce signature turnaround times, reduce costs associated with signatures (paper, shipping, etc.), and boost employee productivity, so there are numerous reasons outside of COVID-related necessity to adopt e-signature software. It is unlikely that businesses that adopted e-signatures during the pandemic will reverse course post-COVID for these reasons. DOCU trades at ~14x trailing EV/Sales, in line with its pre-COVID valuation, and the company recently become profitable trading at ~70x forward earnings.

- Zoom is a leader in global web conferencing with an estimated ~49% market share. Zoom went from an unknown brand to the symbol of how we adapted to the pandemic as a society. While consumer demand for Zoom should decline when we can consistently see friends and family in person, Zoom is likely to remain the to-go web conferencing software for consumers. Business demand will also wane post-COVID but businesses will likely encourage more web conferencing and less travel to keep costs low. Zoom trades at ~35x forward earnings, in line with slower growing US megacap technology stocks, and its net cash balance of US$5 billion keeps the door open to a possible transformative acquisition in future.

Key risk points: Both stocks are speculative and will likely experience above average volatility over time and may experience greater downside than average during equity market downturns.

Jeannine’s Tip o’ the month RRSP and TFSA Contribution Season is Here!

RRSPs: The contribution deadline for the 2021 taxation year is March 1. The maximum RRSP contribution permitted for 2021 is $27,830 (assuming no prior carry-forward room exists). Be sure to review RRSP contributions already made in 2021 and if any carry-forward room or previous overcontributions exist before making RRSP contributions.

TFSAs: Contributions to TFSAs can be made at any time during 2022. The TFSA contribution limit for 2022 is $6,000. This brings the total cumulative contribution room available to $81,500 this year. This amount is available to anyone who has never contributed and been eligible to contribute to a TFSA since 2009.