RRSP AND TFSA OVERCONTRIBUTIONS – WHAT TO DO IF YOU MAKE THIS MISTAKE

Overcontributing to your RRSP and/or TFSA can expose you to unnecessary penalties and can be time consuming to reverse. As a client, allowing SWM to access your CRA My Account can help avoid this problem. Below we explore this issue in more detail.

Overcontributing to RRSPs

Your RRSP contribution room is noted on your previous year’s notice of assessment and can easily be found online at CRA My Account. Your RRSP contribution room does not grow as you earn salary throughout the year but instead is bestowed to you after filing your income tax return.

Overcontributing is easier than you think, especially if you are making monthly RRSP contributions, via an employer plan or otherwise, or you make several lump-sum contributions throughout the year. We have several clients that have recently received a past service pension adjustment (PSPA) tax slip, from their employer sponsored pension plan, that has caused a significant overcontribution problem.

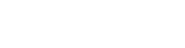

Generally, you have to pay a tax of 1% per month on excess contributions that exceed your RRSP contribution limit by more than $2,000 unless you withdrew the excess amounts or contributed to a qualifying plan. The $2,000 is a buffer for accidental overcontributions while contributing to a qualifying plan allows you to contribute to an employer-sponsored registered savings plan taking into account current year’s employment earnings.

How to unwind an overcontribution?

1, Note your RRSP contribution limit and calculate the excess contributions. This is easier said than done, as contributions made in the first 60 days of the year can be used in the previous tax year, complicating the calculation. Be sure to change savings plans to avoid the problem next year.

2, Withdraw the overcontributed funds as soon as possible. There are two ways to withdraw an RRSP over-contribution, either through a deregistration which is subject to withholding tax or by submitting form T3012A to CRA to request a waiver of the withholding tax. Although using form T3012A avoids withholding, it can only be used in specific circumstances and is a time- consuming process through regular letter mail where CRA approval is required prior to a withdrawal. As time is of the essence with overcontribution withdrawals, it may be advisable deregister the funds with tax withheld. The tax withheld may be claimed as tax paid on your return.

3, On your personal tax return the amount withdrawn will be included in taxable income. However, you may be able to deduct an amount equal to the withdrawal if you received it in the year that it was contributed, in the following year or in the year you were sent a notice of reassessment for the year you made the contribution. In addition, you must have reasonably expected to be able to fully deduct the contributions when you made them. To receive the deduction, form T746 must be used to calculate the deduction for refund of unused RRSP contributions and must be filed with your tax return.

4, File form T1-OVP to calculate the penalty owing on each month you have over contributed. Note that this form is onerous to complete. In addition to the penalty tax, there is a late filing penalty and daily compounded interest that may be assessed. It makes sense to pay the penalty immediately to avoid further interest and penalties. Then contact the CRA to discuss the overcontribution and see if reprieve is available. Filing form RC4288 to request the relief may be required. The CRA considers waiving the penalty tax if the excess contribution was due to a reasonable error and you have taken reasonable steps to eliminate the excess contributions.

Overcontributing to TFSAs

Canadian residents who were 18+ years of age as of 2009, total TFSA contribution room is $75,500. That said, TFSA overall contribution room grows with the TFSA account balance. If your TFSA is worth $100,000 today, you can withdraw $100,000 and recontribute the $100,000 next year. The #1 reason for TFSA overcontributions is investors withdrawing from a TFSA and not waiting until the next year to recontribute.

There is no $2,000 overcontribution buffer for TFSAs. Fixing a TFSA overcontribution is largely the same as an RRSP overcontribution:

- Calculate the TFSA overcontribution. You must file form ‘schedule A – excess TFSA amounts’ which also has a table to help calculate the over contribution as well as penalty tax payable.

- Withdraw the overcontribution as soon as possible

- Pay the 1% monthly penalty tax

- Ask CRA to waive the penalty tax

RRSP and TFSA contribution room can be viewed online via CRA’s My Account.

As an SWM client, we can help you avoid overcontributing to your registered plans.

If you allow us to access your CRA My Account, we are able to verify your available contribution amounts before your contributions are made, ensuring that you do not overcontribute.

Economic Tidbits inflation concerns push interest rates higher & rates + higher = love for value

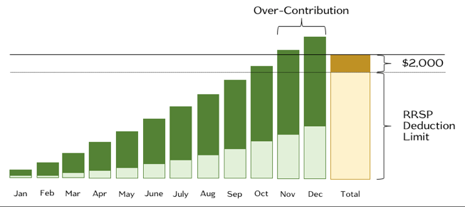

- Since January, inflation expectations have ramped higher as prices of essential goods (oil/gas, food, housing, autos) have spiked. Inflation of financial assets also reinforce this price trend. Higher inflation may solve elevated debt levels but higher inflation means higher interest rates and interest payments. Markets are essentially forcing governments to see if the global economy can stand on its own or not.

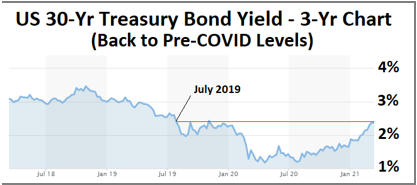

- The rapid rise in commodity prices and interest rates instigated a regime change in equity market leadership from growth-oriented technology stocks to value-oriented financials, industrials and energy stocks as well as cyclical stocks in general. This resulted in the greatest short-term outperformance of the S&P 500 versus the Nasdaq 100 in 20 years and benefitted indices like Canada’s TSX.

Le JIT A “Just-in-TIME” rundown oF our current investment theme

Pipelines Oddly Trading at a Historical Discount Amidst a Major Rally in Energy Prices and Stocks

- TC Energy Corp (TRP) and Enbridge Inc. (ENB) are two ideas related to this theme.

- TC (aka TransCanada) trades at ~11.5x trailing EV/EBITDA, a discount to its historical valuation of 12x, the smallest premium to peers in several years and a rare discount in a stock market that is trading above its historical average. TRP should generate meaningful earnings over time as a core distributor of Canadian long-life energy. TRP, like most pipelines, have barely reacted to the rally in oil prices and the likely boost to Canadian oil production and transportation requirements. Further, Brookfield Infrastructure’s bid for Inter Pipeline shows that there is institutional investor interest in pipelines, highlighting their value.

- Enbridge trades at ~12x trailing EV/EBITDA, in line with its historical valuation and the smallest premium to peers in years. Like TRP, Enbridge should benefit from stable to rising Canadian oil and gas production. Further, Enbridge’s regional natural gas distribution network may soon look like a prize asset as pension funds have difficulty finding inexpensive infrastructure assets amidst a market frenzy for renewable energy projects, which was previously pension funds’ bread and butter for growth over the past decade.

Key risk points: Both stocks have accumulated large debt loads to build out their infrastructure so higher debt costs due to economic stress would impact these stocks in particular. Both stocks also have energy market exposure which makes them sensitive to economic cycles and energy prices.